How They Actually Work Together in Cook County

When a foreclosure summons lands on your door in Cook County, the advice starts flying. “Just sign up for mediation.” “Apply for a loan modification.” “If you’re in the program, they can’t sell your house.”

In real files at the Chancery Division, those half-truths can be dangerous.

This guide is for owner-occupant homeowners in Cook County who want a clear, courtroom-grounded map of how the Mortgage Foreclosure Mediation Program fits together with loan modification and loss mitigation—and where Illinois deadlines still matter even while everyone is “working on it.”

Sharp in law. Connected in your deal.

Schedule a Cook County Mod & Mediation Strategy Session—we map your deadlines, organize a complete hardship package, and plan how mediation and loss mitigation should run in your file before the court sets the next status date.

Two Tracks on the Same File: Court Case vs. Servicer Review

When you’re in foreclosure in Cook County, you are really on two tracks at once:

- The court case in the Mortgage Foreclosure Section of the Chancery Division, filed under the Illinois Mortgage Foreclosure Law (IMFL).

- The servicer’s loss-mitigation review, which is governed by investor guidelines and federal Regulation X (12 C.F.R. § 1024.41).

Mediation lives mostly on Track 1—it’s part of the court’s toolbox to help the parties talk. Loan modification lives mostly on Track 2—it’s a set of options the servicer and investor can offer if you qualify.

- The judge can refer your case to mediation, set status dates, and enforce basic fairness in the process.

- The mediator can help structure conversations, manage document exchanges, and reality-test proposals.

- But the servicer and investor decide whether to offer a trial modification, repayment plan, forbearance, or non-retention option. Regulation X requires procedures and timelines, but it does not require them to give you a specific option.

Mediation is not magic. It’s a communication tool that sits next to your loan-modification review—not above it.

What this means for you this week:

What the Cook County Mortgage Foreclosure Mediation Program Really Is

The Cook County Mortgage Foreclosure Mediation Program is a court-annexed program. It was built to bring homeowners into court early and connect them with free housing counselors and legal aid.

In practice, for an owner-occupied Cook County home:

After you’re served with a foreclosure summons, you can enroll in the mediation program through Cook County Legal Aid for Housing and Debt (CCLAHD) or by referral order on your case.

You’re paired with a housing counselor who helps build your financial and hardship picture.

You may be assigned a legal aid attorney for limited-scope help.

The court enters mediation status orders (often using standard forms) and sets 21-day or 35-day status dates to track progress.

What mediation can do:

Create a structured space—often by Zoom—to talk with a mediator, your servicer’s representative, and your own support team.

Set deadlines for documents and updates.

Document agreements in writing for the judge to see.

What mediation cannot do:

It cannot force the servicer or investor to approve a loan modification or any specific option.

It does not automatically stop or extend Illinois statutory deadlines for reinstatement or redemption. Those rights are created by statute, not by the program rules.

If you expect mediation to “save the house” by itself, you will be disappointed. If you use it to organize your documents, keep everyone accountable, and keep the judge informed, it can be powerful.

Sharp in law. Connected in your deal.

Book a Cook County Mod & Mediation Strategy Session—we line up your mediation status dates with your servicer deadlines and Illinois reinstatement and redemption rights, so you’re not surprised later.

Illinois Foreclosure Deadlines: Reinstatement, Redemption, and the Court Calendar

Even while you’re in mediation, the Illinois statutes keep running quietly in the background.

For most owner-occupied residential property in Illinois:

After service of the summons, you generally have about 30 days to file an appearance and any responsive pleading in the foreclosure case.

You have a statutory right to reinstate—catch up the arrears and costs—to bring the loan current within 90 days of service of the summons. 735 ILCS 5/15-1602.

You also have a statutory right of redemption—paying off the full balance—to reclaim the property until the later of:

7 months after service of the summons, or

3 months after entry of the judgment of foreclosure,

whichever is later, for most residential properties. 735 ILCS 5/15-1603.

The court can move the case forward—enter judgments, set sales—even while you are in mediation, as long as it respects those statutory windows. The mediation program and CCLAD materials are clear that the program does not change state law.

Mini timeline snapshot (typical owner-occupied case):

Month 0: Served with summons.

Days 0–30: Appearance / answer window.

Days 0–90: Reinstatement period.

Month 2–6: Mediation intake, housing counseling, document exchange, status dates.

Judgment entered: Redemption continues until at least 3 months after judgment and 7 months after service, whichever is later.

After redemption expires: Foreclosure sale may be scheduled, unless other factors (bankruptcy, settlement, etc.) change the path.

What this means for you this week:

Mediation and loss mitigation are tools that sit inside those windows. They do not replace them. Someone on your team—ideally your attorney—needs a calendar that tracks both.

Loan Modification and Loss Mitigation Under Regulation X

On the servicer side, your loss-mitigation review is governed by Regulation X (12 C.F.R. § 1024.41) and investor guidelines.

A loss-mitigation application is your package of documents and information asking the servicer to consider options like a loan modification, repayment plan, forbearance, partial claim, or non-retention options such as short sale or deed-in-lieu.

When your application is “complete” under the regulation, the servicer has to:

Acknowledge receipt.

Evaluate you for available options.

Send you a written decision.

In many cases, pause the move toward a foreclosure sale while a timely, complete application is under review or appeal (“dual-tracking” restrictions).

The regulation explicitly states that nothing requires a servicer to offer any specific option. The investor’s rules still drive what’s possible.

Mediation can help keep everyone honest about where your loss-mitigation file stands—but it does not rewrite the federal rule or the investor’s playbook.

What this means for you this week:

The goal is not just “apply for a mod.” The goal is a complete, documented, trackable loss-mitigation file that triggers the servicer’s obligations and fits inside your Illinois deadlines.

Ready to move from uncertainty to underwriting?

Schedule a Cook County Mod & Mediation Strategy Session—bring your summons, any mediation status orders, and your hardship documents. We’ll see whether a loan modification is realistic and how to use mediation to move the file instead of just buying time.

How Mediation and Loan Modification Work Together – A Practical Sequence

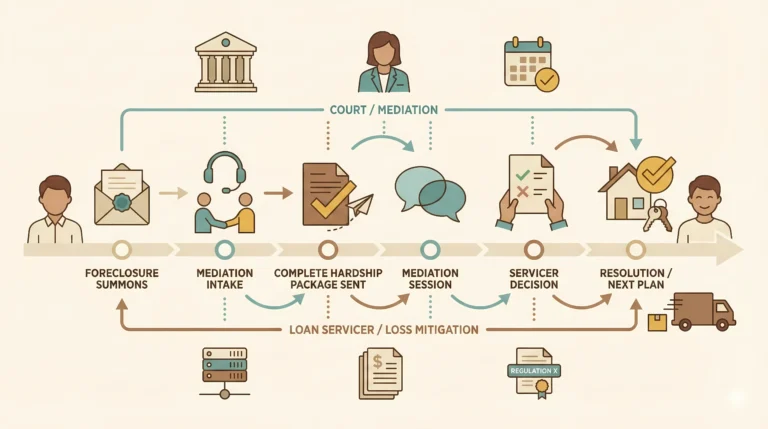

Here is how we often see the two tracks working together for an owner-occupied Cook County home:

- Service and first appearance.

- You’re served with the foreclosure summons.

- You (or your attorney) file an appearance and begin tracking the 90-day reinstatement and redemption windows.

- Mediation intake.

- You contact CCLAD or another program intake line and are screened for the Mortgage Foreclosure Mediation Program.

- A housing counselor is assigned and starts building your budget and hardship story.

- Loss-mitigation application sent.

- With your counselor or attorney, you send a complete hardship package to the servicer, following their exact fax/portal instructions.

- You keep proof of transmission and a copy of everything.

- Referral to mediation and status order.

- The judge enters a mediation referral order and pauses certain motions while the parties work the file, but statutory rights (reinstatement, redemption) still run.

- Status dates are set every few weeks for updates.

- Servicer review and mediation sessions.

- The servicer reviews your application under investor rules and federal law.

- Mediation sessions are used to clear document issues, correct errors, and push toward a concrete option—not just “we’re still reviewing.”

- Trial modification or alternative option.

- If you qualify, you may receive a trial modification offer, usually three months of on-time payments, leading to a permanent modification if you perform.

- If you do not qualify, you may see repayment, forbearance, partial claim / deferral, or non-retention options like short sale or deed-in-lieu.

- Return to court with a plan.

- Successful trial mods and settlements are documented for the judge; unsuccessful attempts lead to a different plan: sale, refinance, or—sometimes—allowing the foreclosure to run while you stabilize.

If mediation is the table where everyone talks, the loan-modification process is the rulebook they bring to the table. You need both.

Example: How One Cook County Homeowner Used Both Tools

We’ll call her “Maria.” She owns a two-flat in Albany Park and fell six months behind after a medical leave.

- Month 0: Maria is served with a Chancery foreclosure summons. A friend tells her to “sign up for mediation; they can’t do anything while that’s happening.”

- Week 2: She calls CCLAD and completes mediation intake. A housing counselor helps her gather pay stubs, tax returns, bank statements, and a hardship letter.

- Week 4: With help, she submits a complete loss-mitigation package to the servicer and gets written confirmation of receipt.

- Week 6: The judge signs a Mediation Referral Order and sets a 35-day status. The court does not extend the reinstatement deadline—90 days from service still controls.

- Month 3: In mediation, the servicer confirms that the file is “in underwriting” and asks for one updated bank statement, which Maria provides within 24 hours.

- Month 4: Maria is offered a three-month trial modification that capitalizes arrears but keeps her payment manageable. The judge continues the case for status during the trial period.

- Month 7: After she completes the trial successfully, the servicer issues a permanent modification. The foreclosure case is dismissed by agreement.

Nothing in that story was automatic. Maria used both tools together—a complete hardship package under Regulation X and a structured mediation program under Cook County rules—to get from panic to a documented, enforceable solution.

FAQs

If I sign up for Cook County foreclosure mediation, will it stop the foreclosure or automatically get me a loan modification?

No. Mediation is a court-connected process that gives you access to housing counselors, legal aid, and a neutral mediator. It can slow down certain hearings and create space to negotiate, but it does not change Illinois reinstatement or redemption deadlines, and it cannot force a lender to approve a modification.

What is the real difference between mediation and loan modification? Aren’t they the same thing?

They are different tools. Mediation is a process run by the court to help the parties communicate and exchange information. Loan modification is a substantive option—a change to your mortgage terms—reviewed and approved (or denied) by the servicer and investor under their guidelines and Regulation X. Mediation can support that review, but it doesn’t replace it.

How do the Illinois 90-day reinstatement and 7-month redemption periods actually work, and what happens if I miss them?

For most owner-occupied homes, you have 90 days from the date you’re served to reinstate—catch up the arrears and certain costs—and keep the loan going. You have at least seven months from service or three months from judgment, whichever is later, to redeem—pay off the full amount. If those periods expire without an agreement or other relief, the lender can move toward a foreclosure sale. Once a valid sale is held and confirmed, your options narrow quickly.

What documents do I need so the servicer can’t keep saying my loss-mitigation file is incomplete?

At minimum, expect recent income proof for everyone contributing, two years of tax returns, recent bank statements, proof of insurance and taxes, HOA or condo statements, a hardship letter, occupancy proof, any prior workout agreements, and a signed third-party authorization. Some investors require more, but if you start here, you’re far less likely to be stuck in “missing one more document” limbo.

Can I work on a loan modification and use mediation at the same time, or do I have to choose?

You can—and often should—do both. In Cook County, many of the strongest outcomes come when a complete loss-mitigation package is in review and the case is in the mediation program. The mediation structure forces updates and gives the judge visibility into what’s happening, while the servicer review determines which options you actually qualify for.

If the loan modification is denied, what is my Plan B?

Plan B depends on your income, equity, and timeline. Common paths include: appealing the denial if there’s an error, negotiating a repayment plan or short-term forbearance, listing the property for sale, exploring refinance, or, in some cases, using bankruptcy or other tools outside the scope of this article. The key is not to wait for a sale date to start that conversation; we build Plan B while Plan A is still in motion.

Ready to move from uncertainty to underwriting?

Book a Chicago Association File Review with The Bow Tie Attorney. We gather the ledger and §22.1 package, issue a written action memo, coordinate the payoff refresh before funding, and push for the recorded release.

Sources

- Circuit Court of Cook County – Mortgage Foreclosure Mediation Program, Chancery Division Mediation. Circuit Court of Cook County+1

- Cook County Legal Aid for Housing and Debt – Mortgage Foreclosure Mediation information. ocj-web-files.s3.us-east-2.amazonaws.com

- Illinois Mortgage Foreclosure Law – Reinstatement, 735 ILCS 5/15-1602. ilga.gov+1

- Illinois Mortgage Foreclosure Law – Redemption, 735 ILCS 5/15-1603. ilga.gov+2illinoislegalaid.org+2

- Regulation X – Loss mitigation procedures, 12 C.F.R. § 1024.41 (CFPB / eCFR). Consumer Financial Protection Bureau+2GovInfo+2

This article is general information about Cook County foreclosure mediation and loss-mitigation procedures as of its “Last updated” date. It is not legal advice. Programs, rules, and statutes change, and outcomes depend on the specific facts of each case. Homeowners should consult with counsel about their own timelines and options.