Every Chicago investor has driven past one of these places. A once solid brick three flat with plywood in the windows. A corner mixed use building with a dark storefront and upstairs lights that never seem to turn on. Grass is overgrown, mail is piled up, and the neighbors just roll their eyes and call it “that building.”

From the sidewalk, it looks like a dead deal. Behind the scenes, it might be a receivership case.

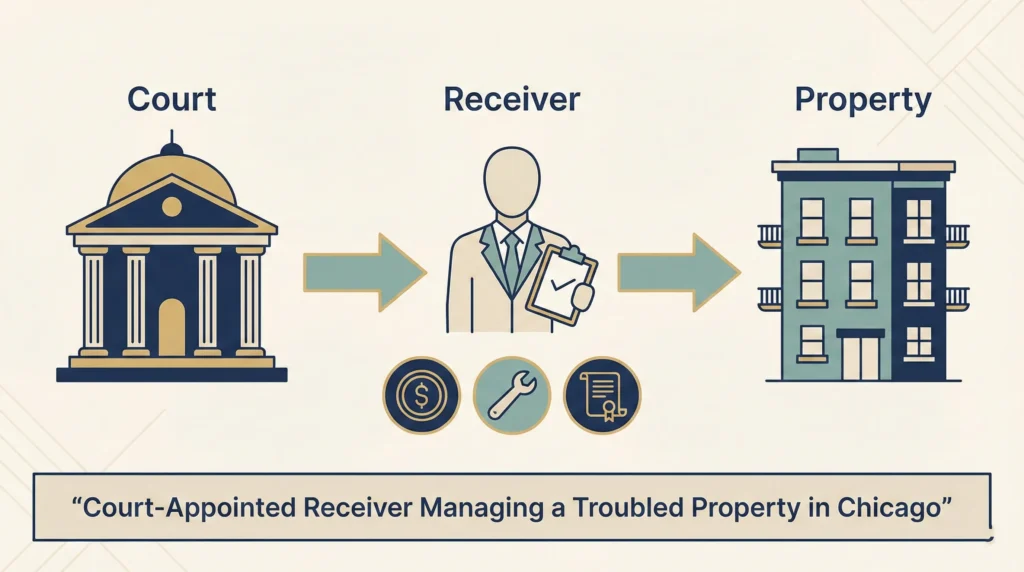

Receivership is a court tool that lets a neutral, court appointed manager step in to stabilize a troubled property. That receiver can collect rent, make repairs, and, in some cases, prepare the building for sale. For Chicago investors who understand the process, receivership can turn a zombie building into a real investment opportunity.

In this article, I am going to walk you through Receivership 101 from an investor’s point of view. We will talk about what a receiver is, how receivership cases start in Chicago and Cook County, and where you can plug in as a buyer, lender, or partner. We will walk through a sample scenario and focus on the legal and financial protections I look for when I advise clients at The Bow Tie Attorney. If you are searching for “receivership deals in Chicago” or “how to buy a distressed building in Cook County,” this is your starting map.

If you keep driving past the same troubled property in Chicago and wondering whether there is a deal buried in the court file, The Bow Tie Attorney can help you find out before you spend time or money chasing it.

A receiver is a person or company that a court appoints to take temporary control of a property while a case is pending. In Chicago, receivers often show up in foreclosure, building code, or nuisance cases where the owner is not maintaining the building, paying expenses, or keeping tenants safe.

The receiver’s job is not to become the new owner. The job is to step into the middle, manage the property under court supervision, and protect its value while the underlying legal fight continues.

Think of a receiver as a court backed property manager with extra powers and extra responsibilities, operating inside a very specific set of orders.

The judge usually gives the receiver authority to collect rent, pay utilities, make emergency repairs, and hire vendors. The receiver works off a budget that is submitted to and approved by the court. Their fees and the money they advance to fix the property often become a lien, which means they may get paid back from the property before other parties in the case. As an investor, understanding those budgets and liens is critical if you plan to bring capital or eventually buy the building.

Receivership does not appear out of nowhere. It usually shows up as part of another case. In Chicago and Cook County, the most common starting points are:

From there, the court issues an order that lays out the receiver’s powers and duties. That order is the playbook for everything that happens next. When investors bring a receivership opportunity to my office, the first thing I read is not the listing or the pro forma. It is the court’s receivership order and the docket around it.

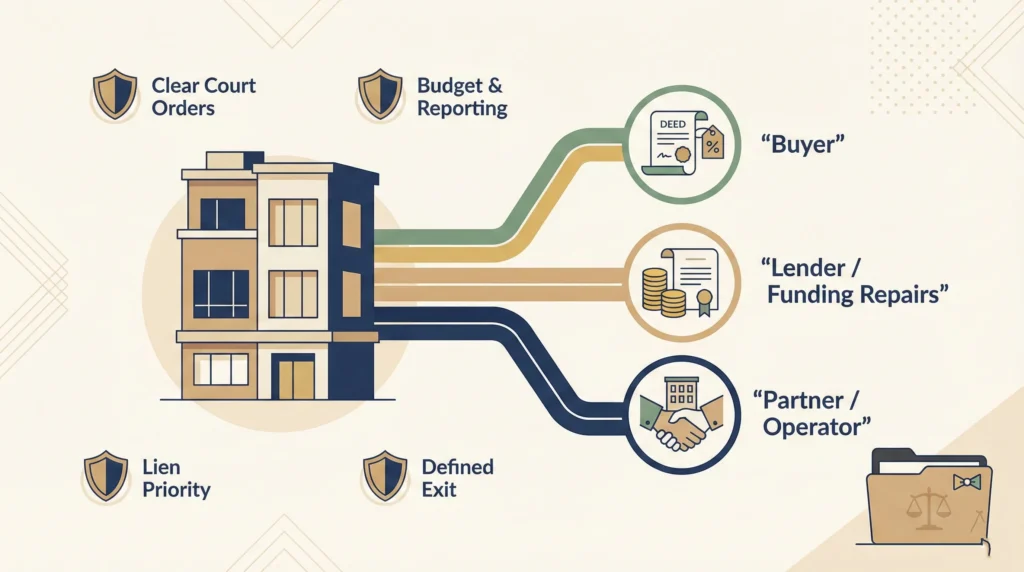

Once a receiver is in place, investors typically show up in three roles. Each one comes with its own opportunity and its own risk profile.

Buyer. You may be looking to buy the property out of the foreclosure, receivership, or a later sale process. In that case, you care about what repairs have been done under receivership, what liens and expenses have piled up, and how the receiver’s work will impact your closing and your title.

Lender. In some cases, investors fund the receiver’s work. That might mean providing capital for repairs through a receiver’s certificate or similar structure that is approved by the court. Done correctly, those advances may sit in a strong repayment position, but only if the orders and priorities are clear.

Partner or operator. Sometimes a receiver or existing party wants an investor to come in as the future operator or equity partner if and when the property exits receivership. In those deals, you have to understand both the current court case and the structure of the future ownership entity.

When I advise Chicago investors on receivership deals, I ask a simple question early on. “Exactly how do you plan to make money here.” If the answer depends on assumptions the court has not approved or on rights that do not exist in the current orders, we either rework the plan or walk away.

To make this concrete, imagine a three story, six unit brick building on the West Side. The lender has filed a foreclosure. The City has an open building code case with violations for heat, water, and unsafe stairs. Two units are occupied by tenants, one by the owner’s cousin, the rest are vacant. The building is in rough shape but sits on a block you like.

The lender and the City both ask the court to appoint a receiver. The judge agrees and signs an order giving the receiver authority to collect rents, make repairs, and bring the property to a minimally safe condition. The receiver prepares a budget for roof work, boiler repairs, and life safety issues and asks the court for permission to borrow money through receiver’s certificates to fund that work.

An investor client calls my office and says, “I heard this might be a receivership play. What do you think.” In our first pass, we review the foreclosure docket, the receivership order, and the budget. We look at priority language for the receiver’s liens, talk through likely repair costs beyond the initial budget, and consider the timing of any future sale or deed transfer. Only after we understand those pieces do we start talking about numbers, financing, and exit strategies.

In the end, that building might become a great acquisition. Or it might be a situation where the legal and municipal weight make it a pass. The difference is not a gut feeling from the sidewalk. It is a disciplined review of how the court has structured the receivership and where your capital would sit in that structure.

Before you agree to fund repairs or chase a receivership building at closing, The Bow Tie Attorney can walk you through the orders, budgets, and liens that will decide whether the deal actually works.

Receivership deals can be powerful, but they are not casual. If you are going to bring money or time into a case like this, you need guardrails.

When I sit down with investors on a potential receivership play, we focus on protections like:

Receivership is not the place to rely on handshake agreements or verbal understandings. The court file is your friend. If a protection you are counting on does not show up in an order or written agreement, we treat it as if it does not exist.

The best time to call about a receivership opportunity is before you promise anyone money and before you let the story in your head outrun the reality in the court file. For most Chicago investors, that means reaching out when:

In our office, receivership work is about matching your investing strategy to a very specific legal framework. My job, as The Bow Tie Attorney, is to translate that framework into plain English and help you decide whether this niche path fits your risk tolerance and your long term plan.

If you are a Chicago investor who wants to look beyond standard listings and simple foreclosures, receivership might belong in your playbook. A strategy session with The Bow Tie Attorney, Mahmoud Faisal Elkhatib, can help you understand when to pursue these deals and when to let them go.

Not exactly. Receivership is a tool the court can use inside different kinds of cases, including foreclosures and building code actions. Some foreclosure properties in Cook County will have a receiver, others will not. A building in receivership may or may not be at a stage where an investor can buy it. The key is to understand both the underlying case and the receivership orders, not to assume that “foreclosure” and “receivership” mean the same thing.

No. Many receivership opportunities involve small and mid-size investors who bring local knowledge and targeted capital. You do not need to be a large institutional player. You do, however, need to be disciplined. That means working with counsel, like The Bow Tie Attorney, who can help you read the court file, understand your position, and document your role properly.

Yes, there is real risk. If the underlying case collapses, the property sells for less than expected, or your priority is not as strong as you thought, you may not recover everything you advanced. That is why we focus so much on the language in receiver’s certificates, budgets, and court orders. We want you to understand the downside clearly and decide whether the potential return justifies that risk.

Often you start with public records. That might mean searching the Cook County foreclosure docket, checking City of Chicago building code cases, or reviewing recorded documents for references to receivers or receiver’s deeds. In practice, many investors bring a specific address to our office and ask us to help investigate the status. Once we know the case number and type, we can read the docket and orders to see whether a receiver is involved.

When used well, receivership can absolutely help stabilize neighborhoods. It allows the court to put a responsible party in charge of a neglected property, fund critical repairs, and preserve housing stock that might otherwise collapse or be demolished. For investors who respect the process, receivership deals can balance private return with public benefit. Like any tool, the value comes from how people use it.

Most investors start with one building they cannot stop thinking about. You send us the address, any information you have, and your rough idea of how you think the deal could work. We pull the court records, look at the receivership orders if they exist, and schedule a strategy call. From there, we tell you whether the opportunity is real, what role might make sense for you, and what protections you would need before putting money at risk.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney