In real Illinois files, missing one payment does not mean a sheriff’s sale is around the corner. But the first thirty to sixty days after that missed payment follow a predictable pattern—and the quiet first week is your best chance to get in front of it.

This guide is for Illinois homeowners, especially in Cook County and the Chicago area, who have just missed a mortgage payment and want to know exactly what happens next and what to do this week, before things snowball into a full foreclosure case.

Sharp in law. Connected in your deal.

If you just missed a payment and know next month will also be tight, schedule an Early-Stage Mortgage Strategy Session. We review your statement, your budget, and your servicer’s rules so you have a week-one plan before this ever becomes a foreclosure case.

What Actually Happens Inside Your Loan When You Miss a Payment

Let’s start with what your servicer typically does in the first month after you miss a payment. The exact dates depend on your loan, but the patterns are similar.

Most mortgages are due on the 1st of the month and have a grace period—often up to 15 days—during which you can pay without a late fee. The payment is technically “late” after the due date, but many servicers don’t charge a fee until after the grace period ends.

After that:

Days 2–15:

Your payment is “past due” in the servicer’s system, but if you pay within the grace period, you usually avoid late fees and negative credit reporting.

Days 16–30:

A late fee (often a percentage of your payment) is added.

You may start receiving reminder letters or calls, but the missed payment is usually not reported to the credit bureaus yet.

A key point: for most mortgages, your servicer doesn’t report you as “30 days late” to the credit bureaus until you are a full 30 days past the due date.

So if your payment was due on June 1 and you pay on June 10, that’s stressful, but in many files:

No late fee yet (if inside the grace period).

No negative credit reporting yet.

If you pay on June 20:

You likely see a late fee.

Still, the payment might not be reported as 30 days late to the credit bureaus—if you make it before the 30-day mark.

This is why the early phase is so important. You have more leverage than you think in that first month.

Days 30–60: When Your Missed Payment Starts Talking to Other People

If the payment still isn’t made, the file shifts from “a little late” to “officially delinquent” in a way that matters outside your servicer.

Ready to move from uncertainty to underwriting?

If you’ve just mapped out your week-one checklist and it’s clear the numbers don’t work, you don’t have to guess what comes next. Book a Week-One Reality Check with The Bow Tie Attorney. We review your payment history, your budget, and your servicer’s likely responses so you know whether this is a one-month problem—or the start of something bigger.

In many loans:

Around Day 30:

Your servicer may report the missed payment as 30 days late to the credit bureaus. This can cause a significant credit score drop, often in the range of 50–100 points depending on your file.

By around Day 36:

Federal servicing rules require the servicer to make or attempt “live contact” with you—actually talk to you about the delinquency and let you know help may be available.

By around Day 45:

The servicer must send a written notice about your delinquency and, in many cases, about loss mitigation options (like repayment plans, forbearance, or loan modification).

By Day 45–60:

Many servicers assign a specific contact person or team to your file so you’re not talking to a completely new person every time.

At this stage, you are still months away from a foreclosure filing under federal rules that generally stop servicers from starting foreclosure until you are more than 120 days delinquent.

And in Illinois, even when a foreclosure is filed, it has to go through a judicial process under the Illinois Mortgage Foreclosure Law (735 ILCS 5/15-1101 et seq.), which takes more time.

But here’s the trap:

By the time you’re 60–90 days late, two things are true:

Your credit has already taken a hit.

You are now behind by multiple payments, not just one, which makes catching up much harder.

That’s why this article is about week one, not month four.

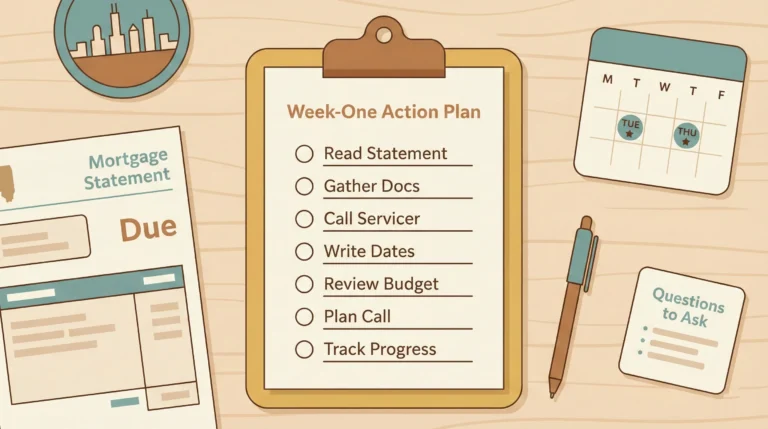

Your Week-One Action Plan: Seven Days to Get Ahead of This

Let’s talk about what to do this week—before letters pile up, before your score drops further, and before your paycheck is already spoken for.

Step 1 – Day 1: Read Your Statement and Know Your Dates

Grab your most recent mortgage statement and look for:

The regular due date (usually the 1st).

Any mention of a grace period (often 10–15 days).

The amount of the late fee and when it applies.

The servicer’s customer service number and hours.

Write down three dates:

The original due date.

When the late fee applies.

The date your payment would be 30 days late.

Those dates will frame the rest of your week.

Step 2 – Day 1–2: Decide If This Is a One-Time Miss or a Pattern

Ask yourself two honest questions:

Was this a one-time emergency (car repair, medical bill, missed paycheck) and you can realistically catch up within the next 30 days?

Or is this a sign of a deeper budget problem—income drop, rising costs, or other debt that makes the regular payment unsustainable?

If it’s a one-time miss and you can catch up within days, your plan is about speed and communication.

If the budget doesn’t work anymore, your plan is about options and strategy—and you shouldn’t try to solve that alone.

Step 3 – Day 2–3: Build a Mini-File Before You Call

Before you ever pick up the phone, gather a small stack of documents:

Your most recent mortgage statement.

Last 30–60 days of bank activity (online or paper).

Recent pay stubs or income proof.

A simple list of your major monthly bills (mortgage, taxes/insurance if separate, utilities, car, credit cards, child care, etc.).

You’re not building a full loan modification package yet. You’re building a snapshot so you can talk about your situation in real numbers, not just “I’m short this month.”

Step 4 – Day 3–4: Call Your Servicer on Purpose, Not in a Panic

Most articles say “call your lender,” but they don’t tell you how.

Here’s a simple script for that first call:

“I’m calling because I just missed my [month] payment on my home in [city], Illinois. This is my first time behind. I want to make a plan to get caught up and understand my options if this lasts more than one month.”

Things to ask:

Late fee:

“When exactly is the late fee applied, and how much is it?”

“Given this is my first late payment, is there any way you can waive the fee if I pay by [date]?”

Credit reporting:

“At what point is my payment reported as 30 days late to the credit bureaus?”

Short-term help:

“Do you offer any short-term options—like moving the due date, a one-time extension, or a short repayment plan—if I can catch up within the next month or two?”

What not to do on that first call:

Don’t promise a payment by a date you’re not sure you can hit.

Don’t say “I’ll pay everything next week” if you know that’s not realistic.

Don’t agree to anything you don’t understand—ask them to repeat and send it to you in writing.

Take notes: who you spoke with, the date, and what they said. Keep these in your mini-file.

Step 5 – Day 4–5: Build a Realistic “Catch-Up” Plan

After that call, sit down with your numbers:

If you can genuinely catch up by the time you would otherwise be 30 days late, that’s the window you’re playing in.

If catching up requires robbing every other bill and leaving nothing for food, gas, or childcare, that’s not a real plan—that’s a delay.

For a lot of owners, the “aha” moment is realizing that they can’t fix this in a single month. That’s the moment to start thinking beyond “I’ll figure it out.”

Step 6 – Day 5–7: Decide Whether You Need a Professional in the File

Here’s where I draw the line in my own office:

You should strongly consider talking to counsel—and not just your servicer—if any of these are true:

You already know you will miss two or more payments in a row.

You’ve had past issues (forbearance, prior mod, pandemic-era relief) and you’re not sure how those affect you now.

Your income has permanently changed (job loss, reduced hours, disability, divorce).

Other debts (credit cards, car loans, medical bills) are competing with the mortgage every month.

In Illinois, especially Cook County, one missed payment does not put you in foreclosure. But repeated delinquency absolutely can lead to a foreclosure filing under the Illinois Mortgage Foreclosure Law—and once that happens, everything runs on a court calendar.

If you’re in that gray zone—more than a one-time miss, less than a full crisis—this is where we come in. We look at the numbers, your servicer’s rules, and your realistic options before anything ever gets filed.

Sharp in law. Connected in your deal.

If you’re in Illinois and already know you can’t fix this with a single paycheck, schedule a Quiet-Phase File Review. We review your mortgage, your budget, and your early servicer communications so you’re not guessing about what happens next.

Letters, Calls, and Emails You’ll Likely See in the First 60 Days

The first two months after you miss a payment usually generate a small pile of paper and phone calls. It helps to know what’s normal.

Typical items in the first 30–60 days can include:

A late payment notice or “you are past due” letter from your servicer.

A statement with a late fee added.

Reminder calls or automated messages asking you to call in.

By around day 36: an attempt at live contact about your delinquency.

By around day 45: a written notice describing that you are delinquent and mentioning the availability of loss mitigation options.

Every servicer brands these differently. The important part is:

None of these, by themselves, are a foreclosure lawsuit.

In Illinois, a foreclosure requires a formal complaint filed in court and a summons served on you—different documents than routine delinquency letters.

Your job in the first 60 days is to:

Open everything.

Keep all mortgage-related mail in a single folder.

Call when the letter says to call—but call with a plan and your mini-file, not in a panic.

FAQs – Missing Your First Mortgage Payment in Illinois

Will one missed mortgage payment automatically put me in foreclosure in Illinois?

No. One missed payment does not automatically trigger a foreclosure lawsuit in Illinois. Federal servicing rules generally prevent a servicer from starting foreclosure until you’re more than 120 days delinquent on your principal residence, and Illinois requires a judicial case under the Illinois Mortgage Foreclosure Law before a sale can happen.

How fast will my credit score drop after I miss a payment?

Most servicers don’t report a mortgage as “30 days late” to the credit bureaus until you are a full 30 days past the due date. If you pay within the first 30 days, you may avoid that negative mark altogether, although you might still owe a late fee. Once a 30-day late hits your credit report, it can cause a substantial score drop and stay on your report for years.

Should I ignore calls from my loan servicer?

Ignoring calls almost always makes things harder. Federal rules require servicers to try to make live contact with you around 36 days of delinquency and send written notices around day 45. Those contacts are often when you first hear about repayment plans, forbearance, or other loss-mitigation options. Answering the phone doesn’t mean you agree to everything, but it gives you information early.

Is it better to pay my mortgage late or skip other bills to stay current?

Your mortgage is usually one of the highest-impact bills for your long-term housing stability and your credit profile. That said, skipping essentials (food, medicine, utilities) or creating new high-interest debt just to make one mortgage payment can be a warning sign that the whole budget needs attention. This is where a counselor or attorney can help you prioritize—especially if you’re juggling multiple debts and irregular income.

If I know I’ll be short again next month, should I still call the servicer now?

Yes. Calling early is not just about this month’s payment; it’s about documenting the hardship and learning what options may be available if the problem continues. Many servicers have short-term programs or can at least tell you what documentation you’ll need if you end up applying for a loan modification or other loss-mitigation option later. Getting that information in week one saves time if things don’t bounce back quickly. ECFR.io+3Chase+3InCharge Debt Solutions+3

When does it make sense to involve a lawyer like The Bow Tie Attorney?

If you truly had a one-time emergency and can catch up within the month, you may only need a good phone call and some budgeting. But if your income has changed, you’re likely to miss multiple payments, or you’re already seeing past-due notices from other creditors, you’re not dealing with a single late payment—you’re dealing with a pattern. In Illinois, that pattern is what eventually becomes a foreclosure case. Talking to counsel while it’s still “just one missed payment” can give you more options, not fewer.

Before this becomes a case, turn it into a plan.

Most Illinois foreclosures don’t start with a sheriff’s sale—they start with a few missed payments that no one really addressed. If you’re already on your second or third late payment, schedule a Pre-Foreclosure File Review. We look at your loan, your income, and your risk window under Illinois law so you can act with a strategy instead of waiting for a summons.

Sources

Consumer Financial Protection Bureau – Mortgage servicing rules: Early intervention (12 C.F.R. § 1024.39) and continuity of contact (12 C.F.R. § 1024.40). Consumer Financial Protection Bureau+4Consumer Financial Protection Bureau+4Legal Information Institute+4

Consumer Financial Protection Bureau / eCFR – Loss mitigation procedures (12 C.F.R. § 1024.41), including the 120-day rule before foreclosure can begin. eCFR+2Legal Information Institute+2

Illinois Mortgage Foreclosure Law – 735 ILCS 5/15-1101 et seq. Justia Law+3Justia Law+3Illinois Legal Aid+3

Educational articles on mortgage grace periods, late fees, and credit reporting for late mortgage payments. mortgageatlashub.com+6The Credit People+6LendEDU+6