Every Chicago investor has a story about the one that got away and the one that should have gotten away. On paper, the two flat in Avondale or the small building on the South Side looks great. The rent roll is solid, the pro forma is exciting, and the listing photos are just good enough to make you forget that something feels off.

Most of the time, the problems that turn those exciting deals into headaches are not about paint color or granite. They live in the paperwork and the public record. Illegal garden units that will never pass inspection. Quiet but expensive building code violations. Sloppy leases that make collection and eviction harder than they need to be. Purchase contracts that give the seller all the outs and you all the risk.

That is where our multifamily deal review comes in.

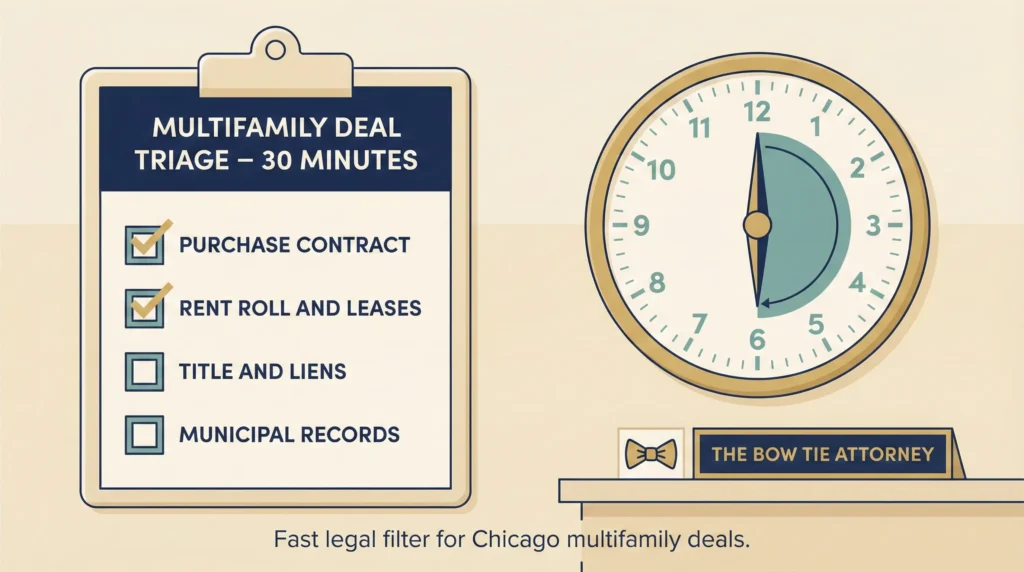

In this article, I am going to show you how we review multifamily deals for Chicago investors inside The Bow Tie Attorney’s office. You will see what happens in a 30 minute legal triage for a two flat, three flat, four flat, or small apartment building, which documents we pull apart first, the red flags that make us tell a client to walk away, and what it sounds like when we tell you the deal deserves real attention. If you are searching for “multifamily real estate attorney in Chicago” or “legal due diligence for multifamily deals in Cook County,” this is your look behind the curtain.

If you are about to write an offer on a Chicago multifamily property, The Bow Tie Attorney can run a fast legal review so you know whether this deal deserves more time or a polite no.

When investors hear “attorney review,” they sometimes picture a slow, expensive process that happens after the contract is signed. Our multifamily triage is different. It is a fast, front end filter designed for small and mid-size Chicago investors who look at a lot of deals and cannot afford to fall in love with every one.

Here is what we ask for on a typical two-to-four flat or small building:

In 30 minutes, our job is not to redesign the entire deal. It is to spot the legal issues most likely to kill your returns or your exit strategy.

We treat this review as a disciplined triage, not a full surgery. I, Mahmoud, move quickly through a checklist we have built from years of Chicago multifamily files. If we find nothing major, we tell you that the deal appears legally normal and is worth a deeper dive. If we find serious structural issues in those first passes, we tell you that too, clearly and early, so you can save your capital and your energy for the next opportunity.

In Chicago, most small multifamily deals start on a version of a standard contract. The danger is not the form itself. It is what gets added, crossed out, or quietly attached on the side.

In a quick contract review, I focus on questions like:

A surprising number of contracts for Chicago two flats and small buildings are copy pasted from single family deals and never updated to reflect the reality of operating a multi-tenant property. In 30 minutes, we can usually tell whether your agreement is close enough to fix, or so one sided that it is not worth saving.

Investors talk about “the numbers” on a multifamily deal as if they are objective facts. In practice, those numbers are only as strong as the leases behind them.

When you send us a rent roll and sample leases, we are looking for red flags like:

I am not trying to scare you out of every deal with imperfect paperwork. I am trying to help you see whether the rent roll you are buying is durable, or whether you are really buying a to do list of lease cleanups and potential disputes. In many cases, we can tell you in simple terms what it will take to bring the leases up to your standard once you own the building.

On the legal side, some of the biggest surprises in Chicago multifamily deals live in the title commitment and the city records. A 30 minute review will not catch every edge case, but it can catch a lot.

For small and mid-size multifamily properties, we focus on:

One of the questions I ask myself during this pass is simple. If this were my building, would I be comfortable inheriting this list on day one. If the honest answer is no, you deserve to hear that before you get attached to the pro forma.

Before you put hard money down on a Chicago multifamily deal, The Bow Tie Attorney can scan the documents and records that matter most and tell you whether the risk fits your strategy.

Not every deal that passes through our office gets the same answer. That is the point. You are paying for judgment, not just a stack of notes.

After a 30 minute review, you usually hear one of three messages from me:

Investors tell me that the red lights are often the most valuable. It is hard to let go of a deal you have been running numbers on all weekend. Having your Chicago multifamily attorney say, “This is not the hill to die on,” in clear, specific language makes the next “no” feel like progress instead of failure.

The best time to loop us in is before you are emotionally committed and before your timeline is impossibly tight. For many investors, that means one of three moments.

However you work, the pattern is the same. You send us the deal. Mahmoud, The Bow Tie Attorney, runs it through our Chicago multifamily checklist. You get a clear sense of the legal red flags, the likely fix costs, and whether this is the kind of building you want your name on five years from now.

If you are growing a portfolio of Chicago multifamily properties and want a fast, practical legal filter on the front end, schedule a strategy session with The Bow Tie Attorney, Mahmoud Faisal Elkhatib, and find out how our 30 minute reviews can plug into the way you already do deals.

Most of our fast triage work focuses on Chicago two flats, three flats, four flats, and smaller apartment buildings where an individual or small partnership is the buyer. We also review mixed use properties with apartments over commercial space, although those sometimes require a little more time. The common thread is that you want a quick legal read on the deal before you invest a lot of money or emotional energy.

At minimum, we need the draft or signed purchase contract, any rent roll or income summary, and the property address with PINs. If you have a preliminary title commitment, sample leases, or municipal reports, those help too. The more you can send in that first email, the more ground we can cover in a short time. If you are not sure what you have, we can start with what is available and tell you what else we would like to see.

No. Think of the triage as a filter, not a full diagnosis. The goal is to spot obvious legal and municipal red flags and help you decide whether the deal is worth a deeper look. If you move forward, we usually shift into a more detailed attorney review that includes negotiation with the seller, coordination with title, and a broader analysis of leases and municipal issues. The triage just keeps you from spending that energy on buildings that never deserved it.

Turnaround depends on our current caseload and how complete your documents are, but many quick scan reviews can be done on a short timeline because they are built to be concise. If you are working with tight offer or attorney review deadlines, tell us that up front so we can give you a realistic expectation. Our priority is to give you an honest and useful answer, not to rush a review that would miss something important.

No. We work with local investors who live in Chicago and the suburbs, as well as out of state investors who are buying in Cook County and nearby Illinois markets. What matters is that the property is in Illinois and that you want someone who understands how multifamily deals play out here, in our courts and in our municipalities. If you invest remotely, having a Chicago real estate attorney who can translate local risk into plain language is especially valuable.

Most investors start with one test case. You send a live deal you are considering, along with the documents you have. We schedule a short call, go through our quick review, and give you a clear read on the legal risk. If the process fits the way you work, we plug it into your deal flow so that sending a property to Mahmoud for a 30 minute check becomes as normal as running your numbers in a spreadsheet.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney