Chicago investors love talking cap rates, ARVs, and exit strategies. Very few want to talk about the fine print in the contracts they are signing every week. Standard Illinois real estate forms feel boring and safe, so everyone rushes through attorney review and inspection and focuses on the number on line one.

In real files, that is exactly how good deals die.

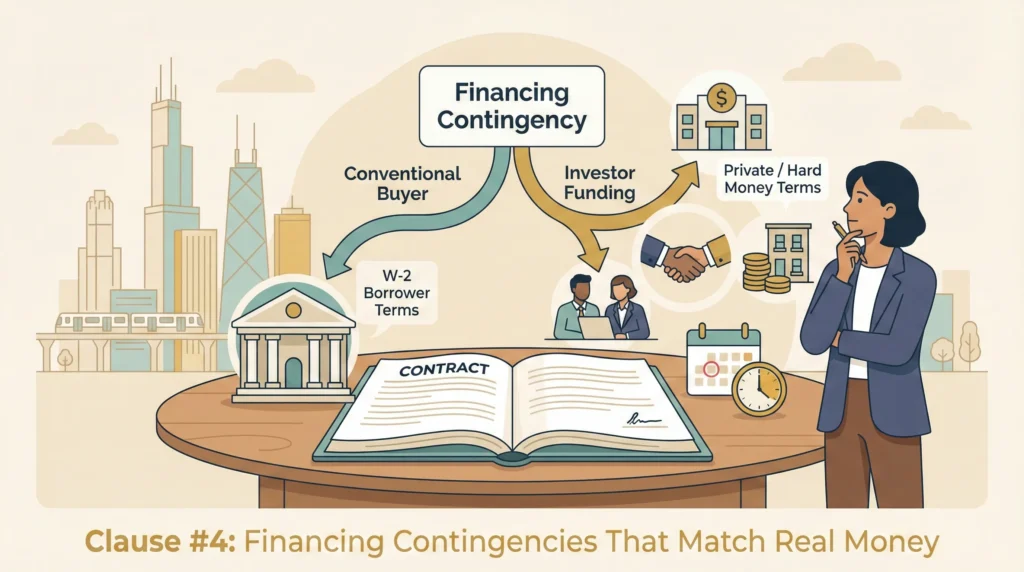

As a foreclosure and real estate attorney who also lives in the investor world, I see the same clauses hurt smart people over and over: an attorney review provision nobody really used, an inspection contingency waived in a casual email, assignment language that did not match the actual wholesale chain, a financing contingency drafted for a W-2 buyer instead of a private-money structure, and rosy rent roll representations the seller never had to back up.

This article walks through five contract clauses Chicago investors routinely ignore—and how they blow up deals later. For each, I will give you a short failure story, the key language to pay attention to, and a more investor friendly way to handle it so The Bow Tie Attorney can fine tune your contracts up front instead of fighting over them in court later.

If you are writing offers on Chicago deals using whatever contract template the last agent sent you, you are not alone—and you are also playing with fire. Standard forms are designed for average owner occupants, not for investors stacking private money, assignments, rent rolls, and tight timelines.

In a Deal First Contract Review, we take your actual purchase or assignment contract, walk through these five clauses, and tune them for the way you really buy, fund, and exit deals in Illinois. The goal is simple: contracts that match your strategy so you do not have to fix them later in front of a judge.

Most investors do not ignore contract clauses because they are reckless. They ignore them because they are moving fast. You have five offers out, a lender to keep warm, and a seller who wants a signed contract by the end of the day. The attorney review and inspection paragraphs feel like boilerplate the agents will “work out later.”

The problem is that the same boilerplate controls who can cancel, who has to cure, who can assign, and who gets sued when everyone is frustrated and the market has moved against you.

In my files, when an investor says a deal blew up, we almost always end up back at a handful of clauses: What did attorney review actually allow? What did the inspection contingency really say about notice and cure? Was assignment clearly permitted or quietly restricted? Did the financing contingency match how the deal was actually funded? And what did the seller really promise about rent rolls and occupancy? If you cannot answer those questions from the contract, you are already behind.

In the Chicago area, attorney review clauses are so common that most people treat them like white noise. The contract goes out, everyone marks the standard five business day attorney review period, and then…nothing. The lawyers are copied, but nobody sends a real review letter unless there is already a problem.

Here is the failure story: an investor signs a standard contract on a small multi in Portage Park. During the first week, he discovers that the rent roll was exaggerated and the taxes are higher than expected. Because nobody used the attorney review period to tighten representations or negotiate repairs and credits, the deal limps forward. By the time he tries to walk away, the seller has spent weeks turning tenants away and lining up their next purchase. Everyone is angry. Litigation follows.

Used well, attorney review is not a courtesy; it is your built in risk filter. In that five business day window, your lawyer can propose changes that: clarify assignment rights, tune inspection and cure obligations for investor style diligence, match financing language to your actual capital stack, and tighten seller representations about rents, occupancy, and condition.

An investor friendly approach is simple: treat attorney review as a required step, not an optional nicety. When we represent you, the contract does not leave week one without a real review letter on file—even if it only confirms key points in writing.

Investors often talk tough about inspections. “It is a value add deal; I will waive inspection” or “We will do our diligence on the side.” The standard inspection contingency gets left alone or casually waived in an email to make the offer look stronger.

That works fine until it does not. Imagine this: you go under contract on a brick three flat in Albany Park. You waive the inspection contingency to beat out another investor. Two weeks later, your contractor opens a wall and finds major structural issues and unpermitted work that change your entire scope and budget. Without a live inspection contingency or any language about seller cooperation with investor style diligence, your options get ugly: close on a bad deal, try to renegotiate with no clear exit, or fight about disclosures and misrepresentation after the fact.

Inspection contingencies for investors do not have to look like a suburban homebuyer wish list. They can be drafted to focus on material structural, safety, and system issues, to give the seller a documented chance to cure or credit, and to let you cancel cleanly if the property is no longer the deal you priced. In other words, they protect both sides from surprises without turning every loose handrail into a federal case.

Assignment language is where a lot of Chicago investors quietly trip over their own feet. Some contracts say nothing at all about assignment. Others say the buyer may not assign without seller consent, or may only assign to an entity controlled by the same purchaser. Wholesalers and joint venturers often sign these without reading, assuming everyone will be flexible later.

Here is a common story: a wholesaler signs a contract on a South Side two flat thinking they will assign to their end buyer. The contract has a standard “no assignment without seller consent” clause. When they find the end buyer, the seller refuses to sign the assignment or uses it to renegotiate price. The wholesaler is stuck in the middle with hard money ticking, earnest money at risk, and their reputation on the line.

An investor friendly contract is explicit about assignment. If you are wholesaling, you want clear language that the buyer may assign to any purchaser or entity designated in writing prior to closing, often with a requirement that the original buyer remains on the hook. If you are the end buyer, you may want to limit assignment to prevent your deal from being shopped to ten different investors while you are trying to underwrite it.

Either way, leaving assignment to chance is an invitation for disputes. The Bow Tie Attorney’s job is to match the assignment clause to the actual way you are doing business on that deal, not to copy and paste from the last one.

Every time you sign a contract with assignment, inspection, attorney review, financing, and rent roll language you did not really read, you are letting someone else write your business plan for that deal.

If you want your paperwork to match the way you actually buy, fund, and exit deals, schedule a Deal First Contract Review with The Bow Tie Attorney. We will read the clauses you have been skimming, show you where they clash with your strategy, and help you build a cleaner playbook for your next round of offers.

Standard financing contingencies are written for W 2 buyers getting a plain vanilla mortgage. Many Chicago investors, by contrast, are stacking hard money, private money, equity partners, or lines of credit. When you drop investor funding into an owner occupant financing clause, the language often does not fit—and you find out the hard way.

Picture this: you go under contract contingent on obtaining a conventional loan within 30 days. Halfway through, your private lender backs out or changes terms. The seller's lawyer points to the contract and says, you were never actually applying for the type of loan this clause describes, so you do not get the escape hatch you thought you had.

A smarter approach is to draft a financing contingency that matches reality. That often means:

When those pieces fit, you can move fast on opportunities without turning every funding hiccup into a breach of contract fight.

On the multi family and mixed use side, the numbers on the rent roll often drive the entire deal. Yet in many Illinois contracts, the seller's promises about income and occupancy are buried in a single vague line or a separate rent roll that is never incorporated into the contract at all.

That is how investors end up buying twelve units with three non paying tenants, two relatives paying half of market rent, and one unit that was never legal to begin with.

An investor focused contract does a few things differently:

When we tune these clauses, the question is not just are the numbers good? It is did the contract actually require the seller to stand behind the numbers they put in front of you? If the answer is no, you are carrying far more risk than you think.

By the time a judge is reading your contract out loud in a courtroom, the damage is already done. The fight is no longer about what makes business sense; it is about what that paragraph on page four technically says.

If you want to keep your deals in the closing room and out of litigation, have The Bow Tie Attorney review your contracts on the front end. We bring Chicago investor experience and Illinois courtroom experience to the same page so your clauses work for the way you actually do business, not against it.

Standard contracts are a starting point, not a custom fit. They are drafted to cover a wide range of residential transactions, often with owner occupants in mind. If you are wholesaling, house hacking, syndicating, or buying value add multis, the default language on attorney review, inspection, assignment, financing, and rent rolls may not match your strategy. The form is not bad; it is just not tailored to what you are actually doing with the property.

Good agents are invaluable, but there are hard lines around what they are allowed to do with contract language. In Illinois, lawyers, not agents, are the ones who are supposed to draft and revise key legal terms. When a clause controls who can cancel, who can assign, or who can be sued, you want someone who spends time in court to have eyes on it, especially if you are doing multiple deals a year.

Not necessarily. The point is not to overload every contract with every protection you can think of. The point is to match the clauses to the deal. On a clean, simple flip with conventional funding, your financing and assignment language might be straightforward. On a creative deal with private money, heavy rehab, and existing tenants, you may need more detail. The key is to decide on purpose, not by default.

It depends how it is done. Slamming a seller with pages of one sided addenda can absolutely cost you deals. But tightening language inside a familiar form, clarifying expectations instead of exploding them, and focusing on a few high impact clauses is often more attractive to serious sellers. Many would rather know exactly how attorney review, inspection, assignment, financing, and rent rolls will work than gamble on a vague, fight later contract.

That is data. A seller who will not budge on obviously mismatched language may be telling you that the risk in the deal is higher than the price reflects. Sometimes the right move is to walk away and deploy your capital on a cleaner deal. Other times, we can help you structure side agreements, disclosures, or pricing changes that make the risk acceptable. Either way, knowing where the seller stands before you close is better than discovering it in litigation.

The best time to bring us in is before a pattern of problems develops. If you are just starting to invest, we can help you build a contract playbook now. If you are already doing volume and have had a few scares or near misses, we can review your existing contracts and recent deals to see where the weak points are. The goal is not to slow you down; it is to make sure the paperwork keeps up with the deals you are actually doing in Chicago and across Illinois.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney