If you listen to real estate war stories in Chicago long enough, you will notice something. When people talk about deals that fell apart, they rarely mention one huge, dramatic moment. Instead, the story sounds like this.

“We were under contract. Then there were some delays with the lender. Then inspection dragged on. Then someone said the earnest money was late. The attorney review deadline passed. By the time we realized what was happening, the seller had moved on.”

From a distance, it looks like bad luck. Up close, it is almost always the same problem. Nobody was really in charge of the calendar.

In this article, I am going to walk you through how earnest money, deadlines, and extensions actually work in Illinois residential and small investment deals. We will talk about how your earnest money deposit connects to your contract rights, how contingency dates for inspection and financing can quietly kill your deal, and how to use extensions the right way. Along the way, I will show you how we, at The Bow Tie Attorney, use simple tools and habits to keep Chicago contracts alive instead of letting them die quietly in someone’s inbox.

If you are under contract on a home, condo, or small building in Chicago or the suburbs, The Bow Tie Attorney can help you map your critical dates so you do not lose a good deal to a preventable deadline mistake.

Earnest money is the deposit you put down to show you are serious about a purchase. In most Chicago area contracts, it is held by a trusted third party, like a brokerage or title company, and credited toward your purchase price at closing.

What many buyers and sellers miss is that earnest money is not just a number on page one. It is tied to specific deadlines and conditions in the contract. When those conditions are met or missed, your rights to get that money back or keep it can change.

Earnest money is the money that sits in the middle of the table while the deal plays out. The contract decides who picks it up when things go wrong.

For buyers, the contract usually gives you paths to recover your earnest money if certain contingencies are not satisfied, such as inspection, financing, or the seller’s inability to deliver clear title. For sellers, earnest money is often your main protection if a buyer walks away without a valid reason. But those protections only work if you follow the rules in the contract: giving notices on time, using the right forms, and documenting why a deal is being cancelled or extended. That is where a real estate attorney earns their keep.

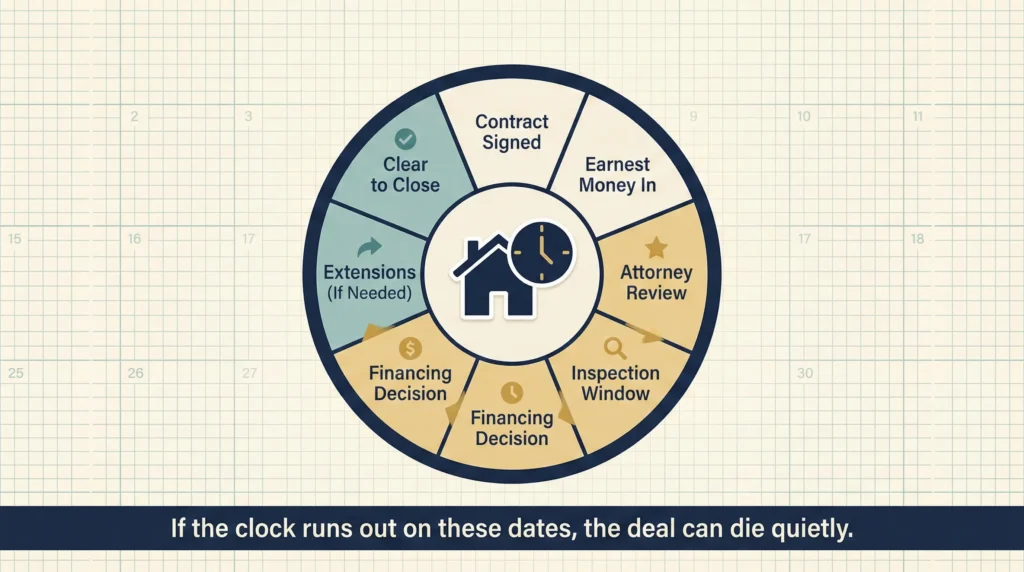

Every Illinois contract has obvious dates: contract date, closing date, maybe possession date. The deals that get into trouble are usually undone by the less obvious ones. The smaller deadlines that live in the middle of the document.

In a typical Chicago contract, those include:

On paper, all of these dates look neat and predictable. In real life, lenders ask for more documents, inspectors get booked, attorneys travel, and agents are juggling multiple files. If no one is actively tracking the dates, they slip by. Once that happens, a buyer’s ability to cancel or demand changes can shrink dramatically, and a seller’s options for enforcing the contract can get messier than they needed to be.

Extensions are the legal way we admit that real life does not fit perfectly inside standard contract windows. Used correctly, they keep deals alive. Used loosely, they create confusion and risk.

In our office, when we talk about extensions, we pay attention to three questions:

One common Chicago pattern we see is the “informal extension.” Everyone talks on email or text and says, “No problem, we can push that back,” but nobody signs a written amendment. Later, when the deal falls apart, each side tells a different story about what was allowed and for how long. The contract, unfortunately, only remembers what was put in writing.

You do not need a complicated system to keep a Chicago real estate contract alive. You do need something more than memory and a messy email thread.

When a new file comes into The Bow Tie Attorney’s office, we create a short, plain language “deal calendar” with three parts:

We share the highlights of that calendar with our clients so they know what is coming and when. When something shifts, we update the calendar and, if necessary, the contract. The goal is that nobody wakes up the morning after a deadline and realizes their options shrank overnight because nobody sent one email the day before.

If you are under contract in Chicago and are not sure what your real deadlines are, The Bow Tie Attorney can review your agreement, build a clear date map, and help you decide how to use extensions and notices without losing leverage.

To understand why this matters, it helps to look at the patterns we see over and over in Cook County files.

Here are a few of the most common:

When I go back through those files as an attorney, I can usually see the moment the deal could have been saved with a simple written extension or timely notice. The tragedy is that nobody realized the clock was about to run out.

In our office, earnest money, deadlines, and extensions are not background details. They are the spine of every closing file.

From the moment you send us a signed contract, we:

Whether you are a first time buyer in Logan Square, a seller in the suburbs, or an investor picking up a small building on the South Side, you deserve a Chicago real estate attorney who treats time as seriously as money. That is how I, The Bow Tie Attorney, approach deadlines in every file that crosses my desk.

If you have a past deal that died for reasons you still do not fully understand, or you are in the middle of a contract now and worried about dates, schedule a strategy session with The Bow Tie Attorney, Mahmoud Faisal Elkhatib. We can walk through your timeline, explain your options, and help you keep your next deal from slipping away quietly.

It depends on your contract and how the other side chooses to respond. In many Illinois contracts, late earnest money can be treated as a default. Sometimes the seller and their attorney are willing to overlook a minor delay if communication is good and the rest of the deal is strong. Other times, especially if trust is already strained, they may try to use the late payment as a reason to cancel or to claim your deposit. The safest path is to treat earnest money deadlines as hard dates and to address any delay in writing before it becomes an issue.

Your rights usually depend on the financing contingency in your contract and whether you followed its rules. Many Illinois contracts give buyers a specific window to obtain a loan commitment or cancel and recover their earnest money. If you miss the deadline, do not provide required notices, or waive the contingency, your ability to get the money back can shrink. That is why it is important to involve your attorney early and to coordinate closely with your lender so everyone knows where you are in the process.

The cleanest way is through a written amendment signed by both buyer and seller (or their authorized agents) that clearly states which contingency is being extended and until what date. Email chains and verbal agreements are risky because memories differ and they may not satisfy the contract’s requirements for modifying terms. In our office, we draft short, specific amendments rather than relying on informal promises.

One of the biggest is letting the attorney review or inspection period expire while everyone is “waiting to hear back.” By the time someone realizes the window has closed, the buyer may have lost the ability to cancel cleanly or demand repairs, and the seller may have lost leverage they did not know they had. The solution is simple but requires discipline: put the deadlines on a real calendar, review them at the start of each week, and send notices before, not after, the last day.

Not necessarily. Extensions are a normal part of many Chicago transactions. They only look weak when they are constant, last minute, and poorly explained. A well structured extension that comes with clear next steps, updated information, or additional earnest money can actually build trust by showing that you are serious and organized. Part of our job is to help you decide when to ask for more time and how to do it in a way that fits your strategy.

The best time is as soon as you have a signed contract, or even earlier if you know an offer is likely. That gives us time to build your date map, spot unrealistic timelines, and suggest changes before you are locked in. If you are already midstream and feeling uneasy about dates, it is still worth reaching out. We can review your contract, look at the calendar, and tell you where you stand and what moves are still available.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney