Most Illinois homeowners experience foreclosure in two chapters. Chapter one is obvious: missed payments, court dates, the fear of losing the house, and a sheriff’s sale looming on the calendar. Chapter two is quieter: credit reports, tax forms, and the question nobody really wants to ask out loud — will the bank still come after me for money after the sale?

That second chapter is where deficiency judgments live.

Under Illinois law, a foreclosure case is not just about taking back the property. It is also about deciding what happens to the difference between what the court says you owe and what the property actually brings at sale. In some files, the lender waives that difference and moves on. In others, it asks the court to enter a personal money judgment for the shortfall and keeps that balance alive after the sale.

This article explains deficiency judgments in plain English: what they are, how they are calculated, when lenders actually choose to pursue them, and what tools exist to negotiate, limit, or avoid that second chapter. Along the way, we will talk about how early planning with The Bow Tie Attorney can turn a vague fear of lifelong debt into a clear understanding of risk and strategy.

If your Illinois home is already in foreclosure or headed that way, you are probably focused on the sale date. But the judgment numbers and the way your case is resolved can shape what happens after that date just as much.

In a Deficiency Risk Strategy Session, we review your loan, your foreclosure complaint and judgment, likely sale outcomes, and your broader financial picture. The goal is simple: understand whether a deficiency is realistically on the table and, if it is, what we can do to limit it, negotiate around it, or plan for it before it shows up as a nasty surprise later.

In an Illinois judicial foreclosure, the lender asks the court for a judgment that does two main things: it authorizes the foreclosure and sale of the property, and it sets the amount the court agrees is due under the loan. When the sheriff’s sale happens, the winning bid is applied against that judgment amount.

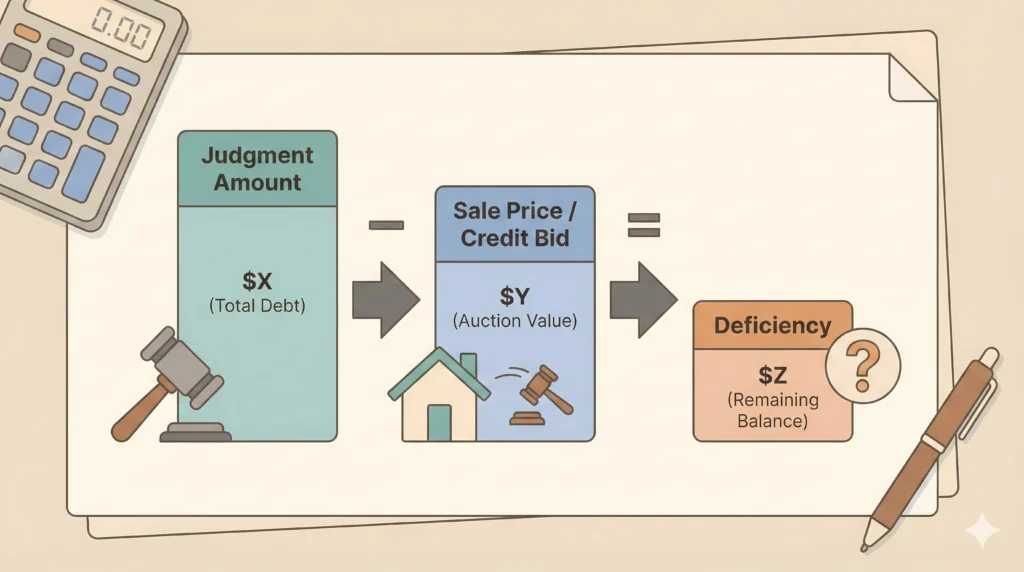

If the judgment says you owe more than the property brings at sale, the gap between those two numbers is the potential deficiency. A deficiency judgment is the court order that says you personally still owe that remaining balance after the sale.

Sometimes the lender and the court handle this explicitly: the judgment of foreclosure will state that the plaintiff is entitled to a deficiency and the order confirming the sale will enter that deficiency amount as a personal judgment against you. Other times, the lender may waive the deficiency in the judgment, especially in owner occupied residential cases where there are negotiations, short sales, or other resolutions in play. Understanding which path your case is on is critical to planning your next move.

At a high level, the math behind a deficiency looks straightforward: start with the final judgment amount (which includes principal, interest, fees, and costs the court has approved), subtract the amount credited from the sheriff’s sale (often the lender’s bid if the bank takes the property back), and the remainder is the potential deficiency.

In real files, a few details matter:

The key takeaway is that the deficiency is not a random number the bank makes up months later. It flows directly from the judgment and the sale result. That is why it is so important to think about deficiency risk while those numbers are being set, not just after the property is gone.

Hearing that a deficiency is possible and seeing a lender actually spend time and money collecting one are two different things. Not every deficiency judgment turns into garnishments, bank levies, or payment plans.

In practice, lenders and their lawyers look at several factors when deciding whether to pursue a deficiency:

The trap for homeowners is assuming that because a friend’s deficiency was ignored, theirs will be too. Illinois law allows for deficiency judgments; whether yours turns into active collection is part policy, part math, and part strategy. That is exactly why you want someone looking at it now, not guessing later.

Even when a deficiency is on the table, you are not helpless. There are several ways to shape, reduce, or manage that risk, depending on your timing and overall situation.

Common approaches include:

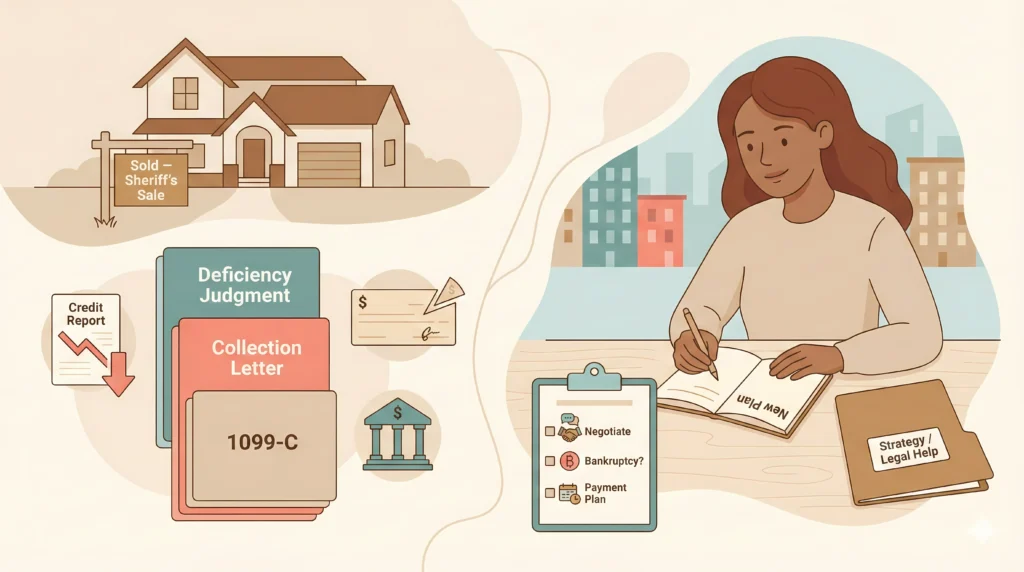

The earlier we start thinking about these tools in your case, the more options we usually have. Waiting until collection letters start arriving after the sale is one of the hardest positions to negotiate from.

Whether a deficiency judgment ever shows up in your mailbox should not be a mystery you discover years after the foreclosure sale. It should be a line item in your strategy from the moment you realize the numbers on your loan may not work.

In a Deficiency Planning Strategy Session, we look at your loan documents, your foreclosure posture, your likely sale outcomes, and your broader financial picture. Then we talk plainly about whether a deficiency is likely, what tools fit your situation, and how to fold that into your plan so you can move into your next chapter with eyes open.

A deficiency judgment is not just a line on a court order. It can affect your financial life long after you have moved out of the property.

Depending on the size of the judgment and how aggressively it is pursued, a deficiency can lead to:

None of this means your financial life is over. It does mean that understanding whether a deficiency is likely, and planning for it along with the rest of your post foreclosure rebuilding, is far better than pretending it cannot happen.

When we take on an Illinois foreclosure file, we are not just thinking about the next status date or motion. We are thinking about the entire arc of your case — including what happens if the numbers do not support keeping the property and a sale becomes likely.

In practical terms, that means we:

The result is a plan that treats the deficiency question as part of your overall foreclosure strategy, not as an afterthought once you have already moved out.

The foreclosure sale is not the final chapter for everyone. For some Illinois homeowners, the real stress starts when they realize the bank still has a piece of paper that says they owe money on a house they no longer own.

If you want to understand where you stand on deficiency risk and what you can do about it, schedule a Deficiency Second Chapter Session with The Bow Tie Attorney. We will look at your numbers, your case, and your long term goals so you can move forward with a strategy instead of a question mark.

Not automatically. The foreclosure sale transfers the property, but the court still has to decide what happens to any shortfall between the judgment amount and the sale price. In some cases, the lender waives the deficiency. In others, the order confirming sale will enter a deficiency judgment against you. The only way to know what happened in your case is to read the final court orders, not just assume the debt vanished when the keys changed hands.

Look at the judgment of foreclosure and sale and the order confirming sale. Those documents usually spell out whether the lender is entitled to a deficiency and, if so, how much. In some orders, the court will state that deficiency is waived as to certain defendants. In others, it will enter a specific dollar amount as a personal judgment. If you are not sure how to read those orders, that is exactly the kind of thing we review in a strategy session.

No. A deficiency judgment gives the lender the legal right to try to collect, but it does not guarantee that it will spend time and money doing so. Some lenders are aggressive; others rarely pursue residential deficiencies. Their decision depends on factors like the size of the judgment, your income and assets, their internal policies, and the cost of collection. The safest approach is to assume they could act and to plan accordingly rather than betting that they will forget about it.

Often, yes. Short sales, deeds in lieu of foreclosure, consent foreclosures, and other negotiated resolutions are common places to address deficiency risk up front. We frequently push for explicit language waiving or limiting deficiencies as part of those deals. Even in a standard foreclosure, settlement discussions before or around the time of judgment and sale can sometimes include agreements about what the lender will or will not pursue later.

Depending on the type of bankruptcy and your overall situation, a deficiency judgment may be dischargeable as unsecured debt, or it may be managed as part of a payment plan. Bankruptcy is a separate legal process with its own rules, pros, and cons. If a deficiency is large and your other debts are significant, we will often suggest that you speak with a bankruptcy attorney as part of a coordinated plan rather than treating the foreclosure in isolation.

The best time is before the sale, while the court is still setting numbers and you still have leverage. That could be early in the foreclosure case, when we are first reviewing the complaint and potential judgment amounts, or later, as you decide whether to contest, negotiate, or aim for a structured exit. Even if the sale has already happened, it is still worth talking through your orders, your exposure, and your options so you are not navigating the second chapter alone.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney