One of the hardest moments for many Chicago homeowners after foreclosure is not the court date or the sheriff’s sale. It is the first time they pull a full credit report and see everything laid out in black and white. Late payments. Collection accounts. A foreclosure entry that feels like a label more than a line item.

It is very easy to sit with that report and think, “I ruined everything.” It is just as easy to go online, see dozens of ads for fast credit repair, and feel a new kind of pressure. Should you dispute every negative line. Should you pay someone a big fee to “clean things up.” Should you ignore it and hope time fixes everything on its own.

In real life, the answer is more measured. Some negative entries are expected after foreclosure and will simply need time. Some are reported incorrectly and deserve attention. A few might justify targeted disputes or professional help. Many will not.

In this article, I am going to walk you through how I, The Bow Tie Attorney, talk with Chicago clients about credit reports after foreclosure. We will look at what you should expect to see, what might be a genuine error, and how to avoid getting lost in myths and fear. If you have ever typed “credit report after foreclosure Chicago” or “what to dispute after foreclosure in Illinois” into a search box, this is meant to help you breathe and think clearly before you act.

If you are in Chicago and your credit report after foreclosure feels overwhelming, The Bow Tie Attorney can walk through it with you, explain what is normal, and highlight what may actually need attention.

Before you decide what to fight, you need to understand what you are looking at. A credit report is a history of how your accounts have been handled over time. After foreclosure, that history will usually include a series of late payments and the foreclosure entry itself.

For a homeowner in Chicago or the surrounding suburbs, the mortgage line often tells a familiar story. On time for years, then a period of thirty, sixty, and ninety day late payments as the financial stress mounts, followed by a notation that the account went into foreclosure or was charged off. Around that main line, you may also see late payments on other accounts that were caught up in the same difficult season.

Your report is not judging your character. It is recording a tough chapter that you already lived. The question now is how you respond to it.

In Illinois, the foreclosure event itself will usually stay on your credit report for a number of years. That can feel heavy, especially in the first twelve to twenty four months when the impact on your score is strongest. Over time, as you build new positive history, the older negative items matter a little less with each passing year. Lenders who work regularly with Chicago borrowers know that life happens. They pay attention to the pattern after the foreclosure as much as the event itself.

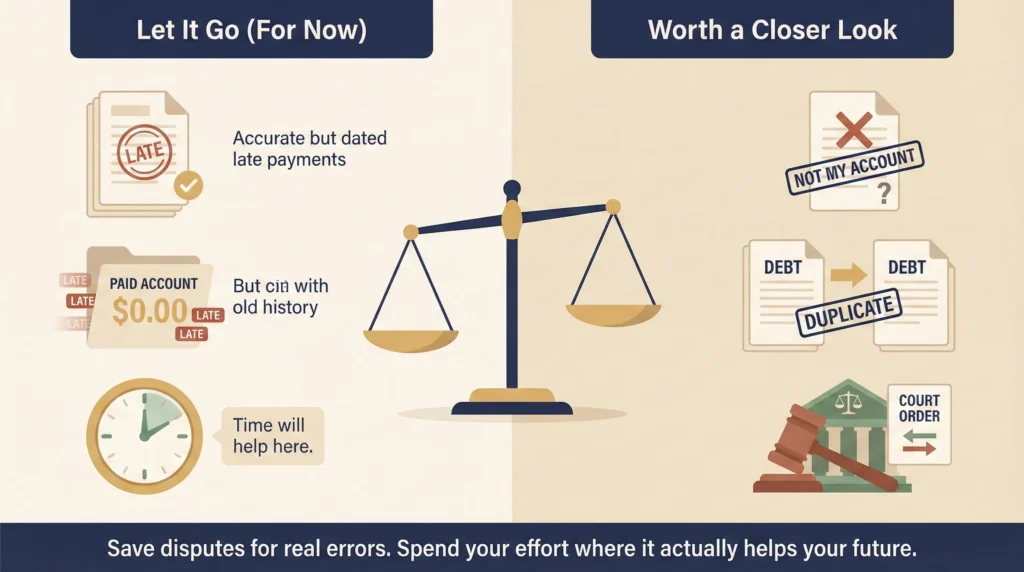

One of the biggest sources of anxiety I see in clients is the feeling that every negative entry must be a mistake, simply because it hurts to see it. The reality is more complicated. Some items are sadly accurate. Others truly are errors. You do not help yourself by treating those categories as the same.

Examples of entries that are often accurate, even if they sting, include:

By contrast, items that may be true errors can include:

When I review a credit report for a Chicago homeowner after foreclosure, I am not trying to scrub the past clean. I am looking for things that do not line up with the real story or with the legal outcome of the case.

Most people know they should pull their credit reports. Fewer know what to check once the PDF is in front of them.

As you read your reports from the major bureaus, it helps to move line by line with a short checklist:

In my office, we often print the reports or use digital notes to mark items as expected, questionable, or clearly wrong. You do not need to be a credit expert to do a first pass. You just need to be honest about what really happened and willing to ask questions where something feels off.

Just as important as what to check is what not to obsess over. After foreclosure, there is a real risk of spending hours and dollars chasing changes that will not move the needle in a meaningful way.

In many cases, it is better to ignore, at least in the short term:

The question I often ask clients is simple. “Will chasing this change materially improve your life or your path to buying again in the next few years, or will it mostly create stress without much return.” For many items, patient rebuilding does more good than endless dispute letters.

If you feel pulled toward every quick fix you see online, The Bow Tie Attorney can help you sort real options from noise so you spend your time and money on steps that move you forward in Chicago, not sideways.

There are situations where it is absolutely appropriate to push back on what you see in a credit report. The key is to be specific, not reactive.

Targeted action can make sense when:

In those cases, it can be appropriate to use the standard dispute channels or, in some situations, to speak with a consumer law attorney who handles credit reporting errors. As The Bow Tie Attorney, my role is often to help you connect the dots between the Illinois court file and what the reports show, so you can see whether the story lines up or where it clearly does not.

What I will not do is promise you that every negative line can be erased. That kind of promise might sell services, but it does not reflect how credit reporting really works for Chicago homeowners after foreclosure.

At the end of the day, credit reports after foreclosure are less about perfection and more about direction. Lenders who work with borrowers in Chicago and throughout Illinois know that people go through hard seasons. What they want to see is what you did after the hard season passed.

That is why, alongside careful review of your reports, I encourage clients to focus on simple, consistent habits:

When former foreclosure clients in Chicago call me years later to ask about buying again, the ones who moved with patience and intention are often in a much stronger position than they expected. My hope, as The Bow Tie Attorney, is that you will see your credit report not as a sentence, but as one tool among many in rebuilding your life and your options.

If you are an Illinois homeowner or former homeowner staring at a credit report after foreclosure and do not know what to think, schedule a strategy session with The Bow Tie Attorney, Mahmoud Faisal Elkhatib. We can look at the report together, separate what matters from what does not, and start planning your path forward in Chicago.

Foreclosures can remain on credit reports for several years, and the late payments leading up to the foreclosure can stay for a similar length of time. The impact on your score is usually strongest early on and softens over time as you build new positive history. Instead of waiting in fear for a certain year to arrive, it is often more helpful to focus on what your profile looks like now, how you are handling current accounts, and what lenders are seeing when they look at your more recent behavior.

Blanket disputes are rarely a good idea. If an item is accurate, disputing it simply because it hurts your score is unlikely to lead to lasting changes and may frustrate you. If an item is clearly wrong or does not match your real history, that is different. In my practice, I encourage clients to reserve disputes for situations where we have a concrete reason to believe the reporting is incorrect, not just uncomfortable.

Be very cautious with anyone who promises to remove a foreclosure or other major event from your reports, especially in a short time frame. If the foreclosure is accurately reported, there is usually no lawful way to make it vanish on demand. Some companies send repeated dispute letters in hopes that an item will fall off by mistake, but that does not change the underlying reality and can sometimes lead to re reporting later. You are often better served by focusing on rebuilding and addressing true errors rather than paying high fees for unrealistic promises.

For many people, checking full reports once or twice a year is enough. That schedule lets you catch errors and track progress without spinning yourself up over every small change in your score. If you are actively working through a specific dispute or issue, you may check more frequently for a period. The key is to treat reports as a tool, not a daily referendum on your worth.

Yes, it can matter. It is tempting to think that once your score is low, additional late payments will not make a difference, but lenders pay attention to recent patterns. A fresh late payment after foreclosure can send the message that the underlying problems are continuing. By contrast, a stretch of clean, on time payments shows that your situation is stabilizing, which can help you over time even if your score is not perfect yet.

You do not have to wait until you are about to apply for a mortgage. Many Chicago homeowners find it helpful to talk earlier, while they are still figuring out what the reports show and how to prioritize next steps. We can discuss how the foreclosure was handled legally, whether there are credit entries that seem inconsistent with that history, and how to align your longer term goals, like buying again, with the way you handle money and credit today.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney