If you have been through a foreclosure in Chicago or anywhere in Illinois, you already know it is more than a legal case. It is a mix of money stress, phone calls you do not want to answer, court dates, and a very personal sense of loss. By the time the property is gone and the file is closed, most people are exhausted.

Once the dust settles, a different question starts to creep in. “Did I just lose my shot at owning a home forever. Can I ever buy again.”

The honest answer is that foreclosure matters. It will sit on your credit report for years. Lenders will ask about it. Underwriters will treat it as a serious event. At the same time, foreclosure does not have to be the end of your homeownership story. With time, better information, and the right habits, many people in Chicago do buy again.

In this article, I am going to walk you through what rebuilding after foreclosure can look like from my seat as The Bow Tie Attorney. We will talk about waiting periods in general terms, how to think about renting versus owning in the meantime, how to rebuild your credit and savings, and how to break the comeback into stages so you have real milestones to aim at instead of vague wishes. If you are asking yourself, “Can I ever buy again after foreclosure in Illinois,” this is written for you.

If you have been through or are finishing a foreclosure in Chicago, The Bow Tie Attorney can help you look past the court case and start building a timeline and strategy for owning again in the future.

First, it helps to separate feelings from facts. Emotionally, foreclosure can feel like a stamp on your identity. “I am someone who lost a house.” On paper, it shows up as an event in your credit history and in your background that lenders will ask about.

From a practical standpoint, foreclosure usually affects you in three big ways:

The important thing to remember is that time and change matter. Lenders do not only look at the foreclosure itself. They look at what happened next. Did things get worse, or did you slowly build a new pattern of on time payments and responsible decisions. That is where your power lives after a hard season.

Your goal after foreclosure is not to erase your past. It is to build such a strong present that the past becomes one chapter instead of the whole story.

When former clients call me a few years after a foreclosure and ask about buying again, my questions are rarely about the court file. They are about what has happened since. Where are you living now. How steady is your income. What does your credit report look like today, not just the year the foreclosure hit. Once we know that, we can talk about realistic timelines instead of guessing in the dark.

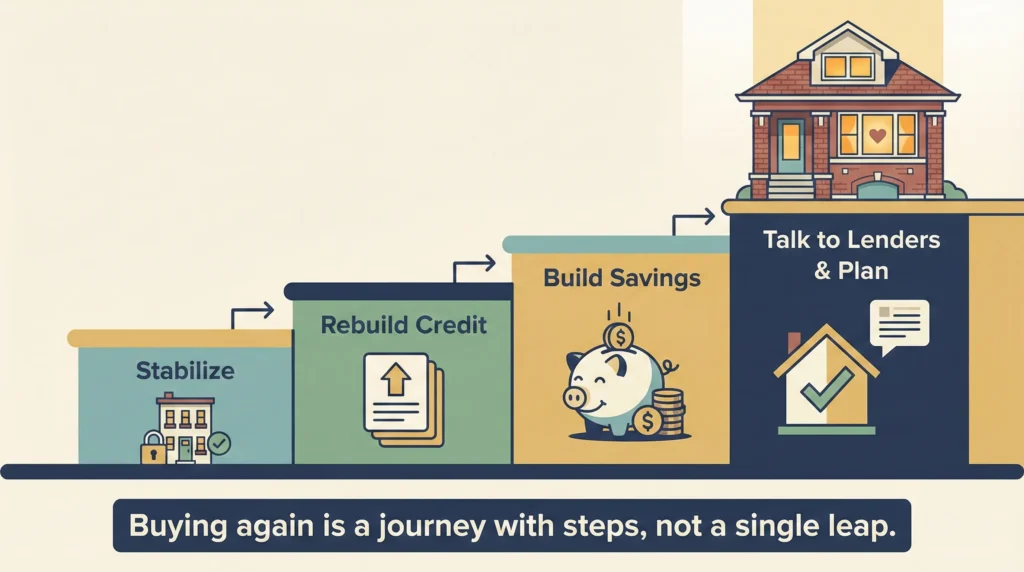

The first stage after foreclosure is not about shopping for a new mortgage. It is about stabilizing your life so that the next time you own, you are building on a stronger foundation.

In this stage, your priorities might include:

This stage is not glamorous. It is also where a lot of the healing happens. When I talk with former homeowners in this phase, we are not mapping out an exact year for the next purchase yet. We are focusing on getting you to a place where you sleep at night, your bills make sense, and chaos is not running your calendar.

At some point after things calm down, you will notice your credit score again. Maybe you pull your report. Maybe a lender gives you a number. Whatever the trigger, it is natural to ask, “How do I fix this.”

Rebuilding credit after foreclosure is usually less about tricks and more about consistent, boring habits. In general, the things that help include:

From a lender’s perspective, time since foreclosure matters, but so does the pattern since foreclosure. Twelve, twenty four, or thirty six months of clean behavior tells a better story than a short burst of effort followed by new missed payments.

While your credit is rebuilding, it is also time to think about cash. The next time you buy, you will want more cushion than you had the last time. That means both a down payment and a real emergency fund.

Some practical questions for this stage include:

In my conversations with former homeowners, I often remind people that “owning again” is not a moral test. It is a financial decision. There are seasons where renting is the smartest move while you rebuild. The key is that you are moving with a plan instead of drifting.

If you know you want to own again someday, The Bow Tie Attorney can help you think through savings targets, risk tolerance, and timing so that your next purchase is built on stronger ground than the one you lost.

At some point, your situation will look different. Your credit will be higher than it was right after foreclosure. Your income will feel more stable. Your savings will be more than a few dollars in a jar. That is when it makes sense to start talking with lenders in a low pressure way.

In this stage, you are not committing to buy next month. You are gathering information. That often looks like:

This is also a good time to loop your attorney back in. When former foreclosure clients call me to say they are thinking about buying again, we look at the legal side of the last case, any remaining issues, and how those might affect future underwriting or title. The goal is to clear as many question marks as we can before you are under contract again.

Most people first meet me when something has already gone wrong. A foreclosure complaint arrives. A lender stops working with them. A sheriff’s sale date is set. My job in those moments is to protect you as best I can inside a tough situation.

What I want you to know is that our relationship does not have to end when the court case does.

For former homeowners, I often help with things like:

My view is simple. You are not just a foreclosure file. You are a person and a family figuring out how to rebuild a life in Chicago after a hard season. If I can help you feel less alone and more informed on that road, that is part of the work too.

If you have been through foreclosure in Illinois and want to know what comes next, schedule a strategy session with The Bow Tie Attorney, Mahmoud Faisal Elkhatib. We can look at where you are now, talk honestly about timelines, and start building a path back to owning on your terms.

The honest answer is that it depends on the type of loan, the lender, and the rest of your financial picture. Many traditional lenders prefer to see a number of years pass after a foreclosure and want evidence that your situation has changed since then. Some programs may be more flexible in certain circumstances. Instead of focusing on one magic number, I encourage clients to think in terms of phases: time for the event to age, time to rebuild on time payment history, and time to build savings. A conversation with a lender who understands your full story will give you a more accurate range than any general internet rule.

Not necessarily. Foreclosures can stay on a credit report for many years, but some people qualify to buy again before the event fully disappears. What lenders look at is the combination of time since the foreclosure, your current credit score, your income and debt levels, and the story your recent payment history tells. The fact that the foreclosure is still visible does not automatically disqualify you, especially if the rest of your profile has become much stronger.

Short sales and deeds in lieu of foreclosure can sometimes be viewed differently than a completed foreclosure, but they are still serious credit events and can involve their own waiting periods. The right choice depends on your specific facts, your lender, and your long term plans. When clients talk to me before things reach a breaking point, we discuss the pros and cons of each option, including how they might show up in future underwriting and what they mean for any remaining debt.

If the foreclosure and related late payments are being reported inaccurately, it can make sense to correct errors. If the reporting is accurate, though, energy is usually better spent on building new positive history rather than arguing about what happened. Lenders often look carefully at patterns of disputes and may have questions if your reports show constant challenges to accurate information. A targeted approach, not a blanket dispute strategy, tends to be more effective.

The right number depends on home prices in the parts of Chicago you are considering, the type of loan, and your comfort level with risk. At a minimum, you will want money for closing costs and some down payment, plus a real emergency fund for repairs and surprises. Many families feel safer with several months of expenses in savings before taking on a new mortgage. When we talk about buying again, we look at your budget together and set savings targets that fit your reality instead of forcing you into a one size fits all rule.

You do not have to wait until the week you make an offer. It can be helpful to talk earlier, even if you are still a year or more away from a realistic purchase. I can help you understand any remaining legal issues from the old foreclosure, talk through lender conversations, and explain what will happen differently next time on the contract and closing side. The sooner you have clear information, the easier it is to make decisions that support your comeback instead of working against it.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney