If you have gone through a foreclosure, short sale, or deed in lieu in Chicago, you already know what it feels like to live inside legal paperwork. Court notices. Sale dates. Closing documents. When the case finally ends, most people just want silence.

Then, often in the next tax season, a new envelope arrives. Inside is Form 1099 C, Cancellation of Debt, showing thousands of dollars in “canceled” mortgage debt. The form goes to you and to the Internal Revenue Service. Suddenly, a chapter you thought was over is back on the table.

At the same time, you might be trying to move forward, maybe with the help of a Chicago foreclosure lawyer you found through the Foreclosure Defense Law Office. You may also be seeing online articles about canceled debt and tax bills, including discussions of federal rules in IRS Publication 4681 on canceled debts and foreclosures or consumer explanations about mortgage debt relief from sites like TurboTax. Those links are helpful, but they can also be overwhelming.

This article is meant to sit between the legal case and the tax return. I am not a CPA, and this is not individual tax advice. My job, as The Bow Tie Attorney, is to explain why 1099 C forms show up after Illinois foreclosures, what questions you should ask a tax professional, and how my office can stay in the loop so that your court file, your credit reports, and your tax filings fit together instead of working against each other.

If you live in Chicago or the surrounding suburbs and just received a Form 1099 C after a foreclosure or short sale, The Bow Tie Attorney can help you understand the legal story behind that form and connect you with a tax professional who can advise you on reporting it correctly.

When a lender forgives or cancels a significant amount of debt, federal rules often require that lender to tell the Internal Revenue Service about it. For many types of consumer debts, including mortgages, that happens through Form 1099 C, Cancellation of Debt. In general, this form is required when a creditor cancels six hundred dollars or more of debt in a calendar year.

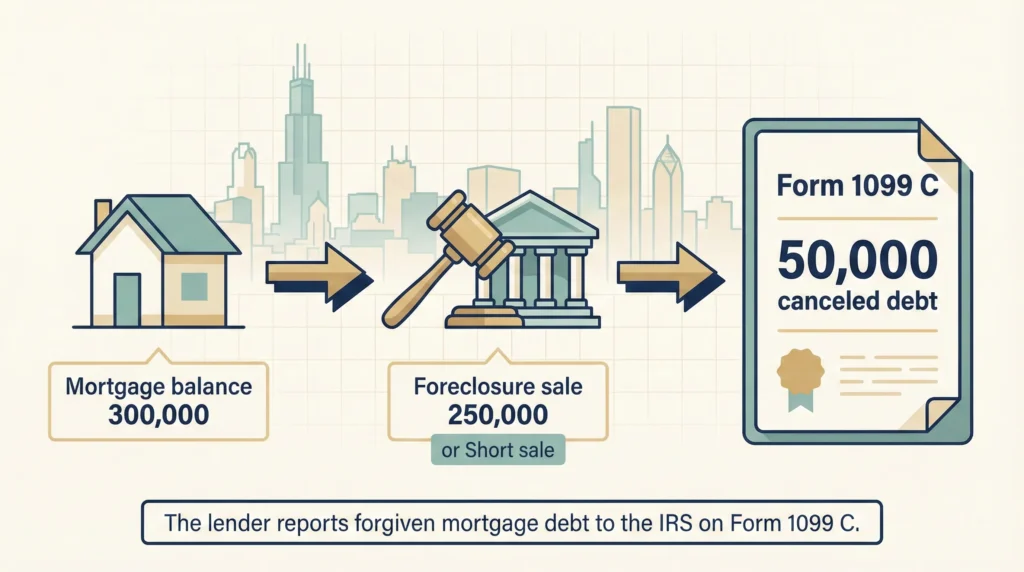

In a typical Illinois mortgage foreclosure situation, that might look like this:

From the lender’s side, the 1099 C is simply a required information return. From your side, it feels very personal, especially if you are already working hard to rebuild after foreclosure. The key question becomes, “Will I owe federal or Illinois income tax on this canceled debt, or is there an exclusion that might apply.” That is where a good tax professional and solid educational resources, like IRS Topic 431 on canceled debt and the latest version of Publication 4681, become important.

The 1099 C is not a bill by itself. It is a signal that the IRS will expect your tax return to say something intelligent about what happened to that canceled debt.

For Chicago homeowners, there is another layer. Federal law and state law both influence how canceled debt is treated. Federal rules set the baseline for whether forgiven mortgage balances might be taxable. Illinois law then uses that federal base income with some adjustments. Guidance from the Illinois Department of Revenue IL 1040 instructions explains how the state return builds on your federal numbers. That is why you want a tax professional who is comfortable with both sides of the equation.

The starting rule in federal tax law is simple, even if the details are not. When a lender cancels a debt you legally owed, the canceled amount is often treated as income. In the eyes of the IRS, if you borrowed money and no longer have to pay it back, that change can look like money that flowed back into your pocket, even if you never saw cash in your hand.

IRS materials, including Publication 4681 on canceled debts and foreclosures, give examples of this idea. In a mortgage context, if you owed three hundred thousand dollars, the property sold for two hundred fifty thousand, and the lender forgave the remaining fifty thousand instead of collecting it from you, that fifty thousand can show up as a number on your 1099 C.

Whether that number is taxable is a separate question. Often, tax software, tax preparation firms, and online tools will walk you through follow up questions about the property, your financial situation, and the type of loan involved. Articles from consumer sources, like the discussion of mortgage debt relief at TurboTax, can help you understand the general idea, but they cannot replace personalized advice.

For several years, federal law created special relief for certain forgiven mortgage balances on a primary residence, sometimes through what is called qualified principal residence indebtedness. That relief has been extended in various ways, including through recent federal legislation that allows some exclusions for discharges through the end of twenty twenty five, although with revised dollar limits. Those rules shift over time, and the details matter, so your tax professional should check the current version of the law, not an old article.

The good news is that not every dollar on a 1099 C automatically turns into taxable income. Federal law recognizes several categories where canceled debt may be excluded from income. Some of the most important questions to raise with your tax professional include:

This is where you and your professionals can get a lot of value from resources like Publication 4681, which walks through canceled debt scenarios, and from local support networks like Cook County Legal Aid for Housing and Debt, which can connect qualifying residents with legal help when tax and debt issues overlap.

Not every situation after foreclosure requires a full team of advisors. But there are clear warning signs that you should talk to a tax professional who understands debt and real estate before you file.

You should strongly consider calling a CPA or enrolled agent if:

In my practice, I often suggest that clients look for a tax professional who has experience with canceled debt and who is comfortable reading legal documents. You can ask whether they have worked with homeowners who brought in foreclosure judgments, settlement letters, or 1099 C forms from Chicago lenders. You can also share educational links, like the IRS description of Form 1099 C and the most recent Publication 4681, so you know you are all looking at the same current guidance.

If you are working with a Chicago tax professional on a 1099 C after foreclosure, The Bow Tie Attorney can coordinate with them so that court filings, settlement terms, and tax reporting all tell the same story and support your long term goals.

In a perfect world, the legal strategy you used during your foreclosure case and the tax reporting you do afterward would be designed as one plan. In real life, people often hire a lawyer in one season and only later realize they also need a tax professional. Part of my job is to help connect those dots.

When a former or current client reaches out about a 1099 C, our office usually:

This collaboration does not turn me into your tax preparer. Instead, it ensures that the story your tax return tells matches the story that appears in the public record at the courthouse. In the long run, that alignment protects you if the IRS ever asks questions about how you reported the canceled debt that appeared on your 1099 C.

The point of all this is not to scare you away from opening an envelope with a 1099 C inside. It is to encourage you to respect what that form represents without letting it take over your life.

If you live in Chicago or greater Cook County and have gone through a foreclosure, short sale, or deed in lieu, your financial story already has enough drama. The tax chapter that follows can be calmer, even if it is not simple. With the right mix of legal context from a foreclosure focused attorney and careful guidance from a tax professional, you can move through this piece of the process with fewer surprises.

External resources, such as IRS Publication 4681, the IRS explanation of Form 1099 C, the Illinois Department of Revenue site, and local support organizations like Cook County Legal Aid for Housing and Debt, are there to help you and your advisors. The key is not to navigate them alone if you do not have to.

My commitment, as The Bow Tie Attorney, is to be part of your long term support system, not just your courtroom advocate. That includes helping you understand how legal choices today may show up as tax questions one or two years from now, and how to prepare for those conversations with confidence.

If you are an Illinois homeowner or former homeowner who received a 1099 C after foreclosure and you are not sure what to do next, schedule a strategy session with The Bow Tie Attorney, Mahmoud Faisal Elkhatib. We can unpack what happened in your case, help you frame the right questions for a tax professional, and work with your Chicago CPA so that your legal and tax strategies move in the same direction.

No. The default rule is that canceled debt can be treated as income, but there are several important exceptions. Depending on your situation, federal law may allow you to exclude some or all forgiven mortgage debt from income, especially if the property was your primary residence, you were insolvent when the debt was canceled, or the debt was discharged in bankruptcy. The exact result depends on current federal rules and your specific facts, so it is important to talk with a tax professional who can apply the latest guidance to your case.

Ignoring a 1099 C does not make it disappear. Because the lender sends a copy to the IRS, your federal return may be matched against that information. If the IRS thinks you left out income or failed to explain why the canceled debt should be excluded, you could face a notice, an adjustment, or in some cases penalties and interest. Even if you believe you qualify for an exclusion, it is better to address the form head on with proper reporting than to pretend it does not exist.

Not everyone needs a full team for a small amount of canceled debt. If the figure is modest and your overall tax situation is simple, carefully following IRS instructions and reputable software may be enough. Still, if you are unsure whether an exclusion applies, if you had a bankruptcy or complex workout, or if you already feel overwhelmed, even a short consultation with a tax professional in Chicago can be worth it for peace of mind and accuracy.

Illinois generally starts with your federal adjusted gross income and then makes specific additions and subtractions. That means many decisions about canceled debt happen first on the federal return, then flow through to the state return. The IL 1040 instructions give guidance on what income to include or adjust at the state level. A tax professional familiar with Illinois rules can help you make sure your federal and state returns tell a consistent story about the canceled debt on your 1099 C.

Yes. While I do not prepare tax returns, I regularly work with CPAs and enrolled agents in Chicago who understand foreclosure, short sales, and canceled debt. I can help you think about what to look for in a tax advisor, share the legal context of your case with them once you give permission, and be available when they have questions about how the foreclosure or settlement unfolded.

Earlier is usually better. If you are still in the middle of an Illinois foreclosure and already worried about future tax consequences, tell your lawyer now. Certain choices about timing, sale structures, or legal strategy may have tax consequences later. While I will always remind you to confirm the tax side with a professional, raising the issue during the case gives us a chance to think ahead instead of reacting after the fact.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney