Ask most buyers or new investors what stressed them out about their Illinois closing, and you will hear about loan approvals, inspection repairs, or last minute credits. Very few people will say, “The title commitment,” even though that quiet PDF decides a lot about what you really own when the dust settles.

In almost every file, there is a moment when the title company emails a document labeled something like “Title Commitment” or “Preliminary Report.” Agents skim it. Lenders file it. Buyers and sellers rarely read past the first page. Then, if a lien or exception pops up at the eleventh hour, everyone panics.

It does not have to work that way.

In this article, I am going to walk you through title commitments for humans. We will talk about what a title commitment actually is, how its sections are organized, what kinds of liens and exceptions we see most often in Illinois deals, and how I, The Bow Tie Attorney, sort issues into fixable problems versus true red flags. The goal is simple. When you hear that your title commitment is in, I want you to know what that means and how our office uses it to protect you before you sit down at the closing table.

If you have a title commitment in your inbox and are not sure what it means, The Bow Tie Attorney can translate it into a simple list of what is normal, what must be fixed, and what would make us think twice.

A title commitment is the title company’s promise to issue a title insurance policy at closing, if certain conditions are met. It is not the policy itself. It is the blueprint for what the policy will cover and what it will not.

The title company is saying:

The title commitment is the part of your file where the past, present, and future of your property all sit on a few pages together.

For Illinois buyers and investors, that document matters because it tells you what problems must be resolved before you close and what long term limitations will survive your closing even if everything goes “perfectly.” When clients send me their title commitments, my first job is to make sure the commitment matches the deal we think we are doing: the right property, the right seller, and no surprises hiding in the fine print.

Different title companies format commitments slightly differently, but most follow the same basic structure. Once you know what each section is trying to tell you, the document feels much less intimidating.

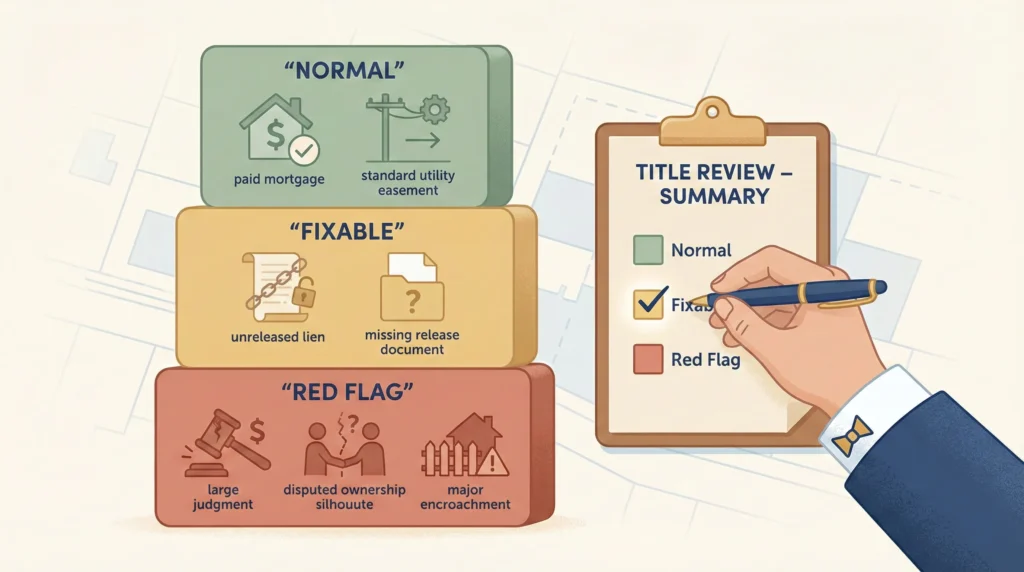

When I review an Illinois title commitment, I usually think in terms of three big buckets:

Inside those buckets, there are smaller moving parts. For example, one section may list current mortgages and liens. Another may list recorded easements (like utility lines or shared driveways). Another may reference subdivision restrictions or condo declarations that control how the property can be used. My job is to read each item and think about what it means for you, not just whether it fits a technical category.

Most title commitments in Chicago and the surrounding suburbs show a few usual suspects. Seeing them is not automatically a problem. Ignoring them can be.

Some of the most common items we explain to clients include:

On a clean file, many of these items are routine. The seller’s existing mortgage is paid off, taxes are brought current, and normal easements are disclosed and insured around. Where things get interesting is when the title search reveals old unreleased liens, unexpected judgments, or restrictions that do not match how you plan to use the property.

Not every title issue is a reason to walk away. But not every problem is easy or cheap to fix either. Part of what you hire a real estate attorney for is the judgment to tell the difference.

When I review a title commitment for a buyer or investor, I mentally sort issues into three categories:

For clients, the most useful part of this process is not the labels themselves. It is the conversation we have about what each category means for your money, your timeline, and your stress level. A risk that might be acceptable for an experienced investor can be completely wrong for a first time homebuyer with a tight budget.

Before you assume your title is “fine” because everyone else seems calm, The Bow Tie Attorney can review your commitment, explain the real risks, and help you decide whether to push for fixes, negotiate, or walk away.

Title commitments are not meant to be static. They are working documents that should change as issues get cleared. A big part of our job is making sure that actually happens before closing day.

On a typical Illinois file, our title work includes steps like:

From your perspective, this often looks like a few emails and a calm explanation that “title is clear.” Underneath that calm, there is usually a fair amount of quiet back and forth to get us to that point.

Most clients are not looking for a lecture on title insurance. They want to know three things: Is this normal. What should I be worried about. What are we doing about it.

In my office, a title review usually ends with a short, plain language summary that answers those questions. You see:

Sometimes that summary ends with, “This title looks clean. Let’s close.” Other times, it ends with, “We need to resolve these issues before you sign,” or even, “This property carries baggage that does not fit your goals.” Whatever the answer, my goal as The Bow Tie Attorney is that you never sit at a closing table wondering what those pages you signed actually mean.

If you are buying a home or investment property in Illinois and want more than a shrug when it comes to title, schedule a strategy session with The Bow Tie Attorney, Mahmoud Faisal Elkhatib. We will go through your commitment together so you know exactly what you are stepping into on closing day.

A title search is the research the title company does in public records to see what is recorded against the property – deeds, mortgages, liens, easements, and so on. A title commitment is the written document that comes out of that research. It tells you what the title company found, what conditions must be met before they will insure, and what exceptions they are not willing to cover. The commitment is your chance to review and fix issues before you rely on the final title policy.

The title company’s job is to protect its own risk and issue a policy under certain terms. Your attorney’s job is to protect your risk. Those interests overlap, but they are not identical. I often agree with the title company’s conclusions, but sometimes I see patterns or long term risks that matter more to you than to them. Having an attorney like The Bow Tie Attorney review your title commitment means someone is looking at it through your eyes, not just through the lens of the insurer.

A title exception is something the title insurance policy will not cover. That might be an easement, a recorded restriction, or another interest in the property that the title company is not taking responsibility for. Some exceptions are routine – like visible easements for utilities or standard subdivision covenants. Others can be more serious. When I review your commitment, I pay close attention to the exceptions to see whether any of them could interfere with how you plan to use, improve, or sell the property.

It depends on the type and amount. Many liens and judgments can be resolved before closing by getting accurate payoff letters and using sale proceeds to pay them off. In some cases, we may need to track down creditors, negotiate amounts, or ask the title company to accept certain arrangements. If the lien is very large, disputed, or tied to deeper ownership problems, we may advise you to delay closing until it is resolved or consider walking away. The key is to address the issue before you sign, not after.

Yes. If a title commitment reveals issues that require payoffs, releases, or additional documentation, your closing may need more time. That does not mean the deal is doomed. It does mean your attorney and the title company need to work together quickly and clearly. Part of our role is to let you and your agent know early if title issues are likely to affect timing so you can adjust expectations and negotiate extensions if needed.

The sooner, the better. As soon as the commitment is issued, forward it to our office along with any notes from your agent or the title company. That gives us time to review, ask questions, and push for fixes while there is still room in the schedule. Waiting until the day before closing to look at title is like reading the instructions after you have already built the furniture. It is technically possible, but it is a lot harder to fix anything that went wrong.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney