If you have been condo shopping in Chicago, you know the pattern. You walk into a unit, and the first thing you notice is the kitchen. Stone counters. Stainless appliances. Maybe a skyline glimpse from the balcony. It feels good. You can see your furniture in the living room. You imagine mornings with coffee and evenings with the lights of the city outside.

What you do not see on that first visit is the association’s budget. You do not see the reserve study warning about a roof replacement in three years. You do not see the email threads about a lawsuit with the developer or the special assessment that owners are quietly paying off in installments.

Those details live in the condo resale disclosures and association documents. That is where the real story sits.

In this article, I am going to walk you through how I, The Bow Tie Attorney, approach condo resale disclosures and special assessments for Chicago buyers. We will talk about what those documents are supposed to show, how budgets and reserves reveal the building’s true health, what questions you should be asking about projects and board politics, and how I review these materials to keep clients from buying into trouble. If you have ever searched for “what to look for in Chicago condo docs” or “special assessments in Chicago condos,” this is the conversation I want you to have before you sign.

If you are under contract on a condo in Chicago or the suburbs, The Bow Tie Attorney can review your resale disclosures, budgets, and assessment history so you know what you are really stepping into before you close.

When you buy a condo in Chicago, you are not just buying a box in the sky. You are buying into a small business the association runs for the building. The resale disclosure and related association documents are your snapshot of that business.

Depending on the property and the contract, you may see some or all of the following:

Unit photos tell you how the seller lives. Condo documents tell you how the building lives.

In Illinois, and especially in the Chicago market, contracts often give buyers a period to review these documents and cancel if the information is not satisfactory. That right is only valuable if you actually read what you receive. When clients hire me to review condo disclosures, my job is to translate those pages of numbers and board language into a simple question. “Does this building make sense for you at this price, with your plans, right now.”

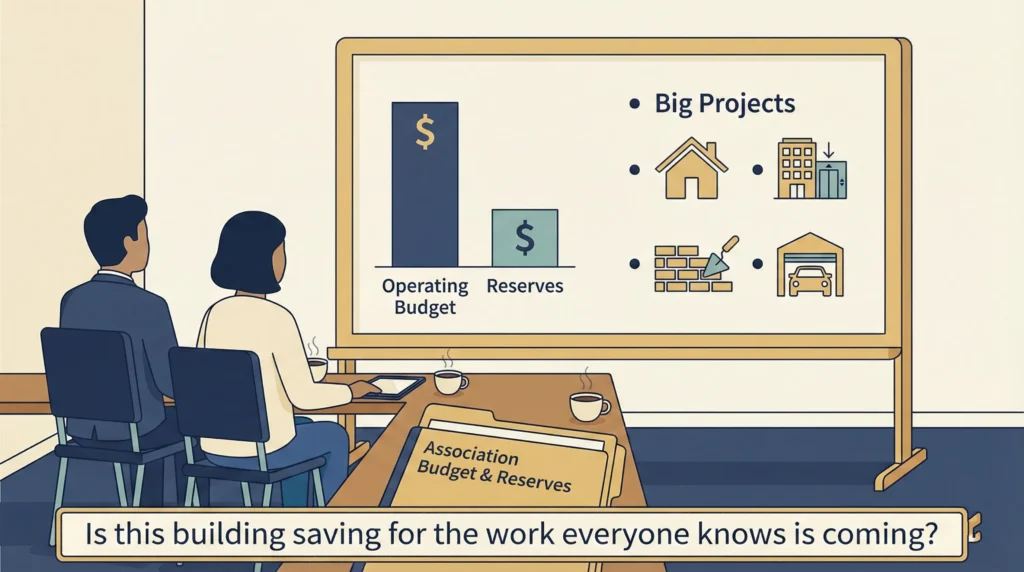

One of the first places I go in a condo file is the budget and reserve information. The numbers will not predict the future with precision, but they will tell you how the association thinks about money.

When I review a Chicago condo budget, I am looking at questions like:

A building with modest assessments and healthy reserves may justify a premium price because your risk of big surprises is lower. A building with rock bottom dues and a thin reserve account may be cheap for a reason. My job is not to tell you what to want. It is to help you see the tradeoffs so you can decide whether the budget and reserves fit your risk tolerance.

Special assessments are one time charges the board imposes when the regular budget and reserves are not enough to cover a major expense. Roof replacement. Elevator modernization. Masonry restoration. Lawsuit settlements. If you own a condo long enough, you will probably see at least one.

When I talk with buyers about special assessments, we break them into three buckets:

Listing language will not always call these out clearly. Sometimes you see phrases like “no known pending specials” while the minutes are full of discussion about an upcoming project. That is why I ask clients to send not just the disclosure form, but also board minutes and any recent owner communications they can obtain.

Beyond the raw documents, there are specific questions that help you understand whether you are buying into a stable building or a slow motion problem. When I represent Chicago condo buyers, here are some of the questions we usually discuss:

You may not get perfect answers to all of these questions, but asking them changes how you read the documents in front of you. It also helps you and your real estate agent decide whether to push for more information, more time, or different terms.

Before you fall in love with a kitchen and a view, The Bow Tie Attorney can look at the condo’s disclosures, financials, and special assessment history and tell you whether the building’s story matches the listing’s story.

When clients send me condo documents, they are usually feeling one of two ways. Either they are excited and want reassurance that everything is fine, or they are overwhelmed and afraid they are missing something big. My job is to bring structure to both situations.

Inside The Bow Tie Attorney’s office, a condo document review typically looks like this:

I cannot promise that a building will never impose a special assessment or face a surprise. No one can. What I can do is help you spot patterns I have seen before in Chicago condo associations that signal avoidable trouble ahead.

The best time to bring me into a Chicago condo deal is as soon as you know you are serious about a unit and certainly no later than the start of your document review window. That gives us enough time to read, ask questions, and respond before your rights shrink.

In real files, that often looks like:

Whether this is your first Chicago condo or your fifth, you deserve more than a quick “looks fine” on the association. You deserve a measured, honest read. That is how I, The Bow Tie Attorney, approach condo disclosures in every file you trust me with.

If you are under contract on a condo in Chicago and want to know whether the association makes sense for you, schedule a strategy session with The Bow Tie Attorney, Mahmoud Faisal Elkhatib. We will walk through the disclosures together so you can sign with clear eyes or walk away with confidence.

Condo resale disclosures are packets of information the association provides when a unit is sold. They typically cover assessments, reserves, special assessments, insurance, litigation, and basic building data. For Chicago buyers, these disclosures matter because they reveal the financial and legal health of the building you are about to join. A unit can look perfect while the association is struggling with debt, deferred maintenance, or lawsuits. Reading these disclosures carefully, ideally with an attorney, helps you avoid those surprises.

Special assessments are not automatically a reason to run away. Sometimes they mean the association is tackling necessary work responsibly instead of ignoring problems. The key is context. How large is the assessment compared to regular dues. What work is it funding. Is it a one time event or part of a pattern of underfunded reserves. When I review a file, I focus less on whether a special assessment exists and more on what it says about how the building handles major expenses.

Low reserves with no current specials can be a warning sign that you are buying during the quiet before a storm. If big projects are looming and the association has not saved for them, owners are one board vote away from a special assessment. That does not mean the building is unbuyable, but it does mean you should adjust your expectations and budget. In some cases, it may also affect the kind of financing you can obtain, because some lenders look at reserve funding in their condo review.

You should absolutely read the rules and regulations yourself, even if your agent and attorney are also reviewing them. There may be lifestyle issues that matter more to you than to anyone else, such as pet limits, rental caps, quiet hours, balcony use, or in unit modifications. I can flag legal and structural concerns, but only you know how you want to live. The best outcomes happen when we combine your priorities with my legal read and your agent’s market sense.

Good questions include: whether any large projects are planned in the next few years, whether the association is considering special assessments, what the delinquency rate is among owners, whether there is current or expected litigation, how insurance premiums have changed, and how often assessments have increased historically. You can also ask practical questions about parking, storage, security, and how responsive management is to maintenance requests. The answers, and how they are delivered, tell you a lot about the building’s culture.

There is no universal rule. Some buyers walk away when they see underfunded reserves and a major project on the horizon. Others are comfortable taking that risk in exchange for a lower purchase price or a prime location. I usually recommend a hard conversation when the documents show a combination of several issues: serious litigation, very low reserves, high delinquencies, and a history of frequent special assessments without structural changes in how the building handles money. In those cases, your purchase price is only part of the cost. My role is to lay out the facts and the patterns I see so you can decide whether this is a story you want to join.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney