If you read enough articles about foreclosure defense in Illinois, the work can sound strangely flat. File an appearance. File an answer. Ask for more time. Hope for a modification. From that distance, every case looks the same.

Inside our office, that is not how it feels at all.

The day a new Cook County foreclosure file lands on my desk, I am not thinking about forms. I am thinking about three things. First, your story and what you want your next chapter to look like. Second, the hard dates the court and the law have already put on your calendar. Third, the tools we can use over the next several months to move you from panic toward a controlled outcome.

This article pulls back the curtain on how foreclosure defense really works at The Bow Tie Attorney. I will walk you through what happens after you call us, how we build your defense strategy, how we coordinate with servicers and mediators, and how we decide when to push a case hard and when to lean into settlement. The goal is simple. If you search for “foreclosure defense lawyer in Chicago” or “Cook County foreclosure help,” I want you to know what it actually feels like to work with us, not just what the statute says.

If you are staring at a foreclosure summons or a packed court docket, The Bow Tie Attorney can turn that noise into a step by step defense plan you can actually understand.

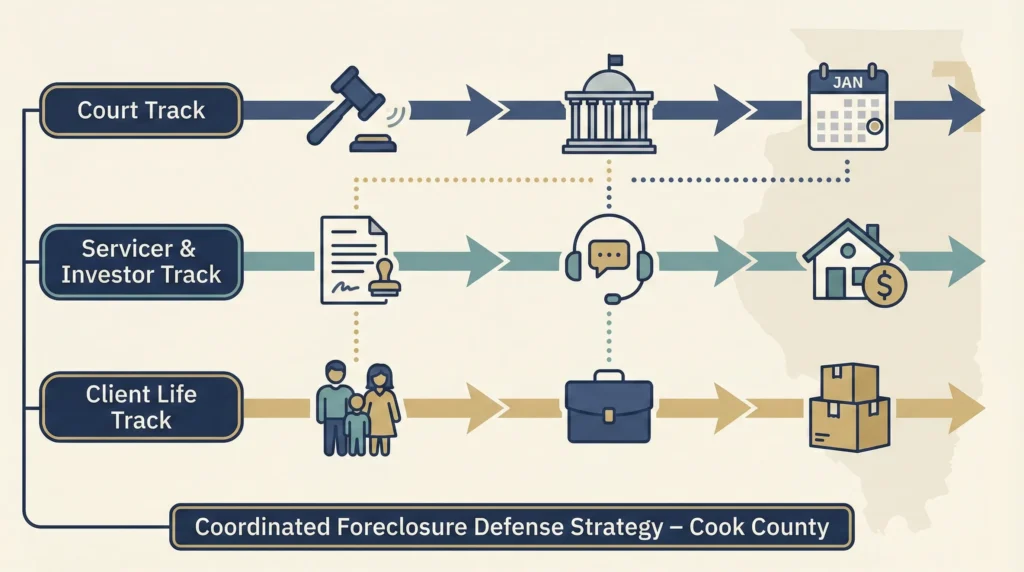

On paper, foreclosure defense looks simple. There is a complaint, an answer, some motions, a judgment, maybe a sheriff’s sale. The reality in an Illinois foreclosure defense practice is much more layered. Every case has three tracks running at the same time.

Real foreclosure defense is the art of keeping those three tracks lined up so that court strategy, servicer negotiations, and your actual life all point toward the same outcome.

Sometimes that outcome is saving the home with a restructured loan. Sometimes it is using the case to buy time for a short sale or a deed in lieu that cleans up a deficiency. Sometimes it is simply making sure that if you have to leave, you do it on a schedule that respects your family’s reality instead of the bank’s convenience. When you hire us, the first thing we do is figure out which version of “success” you care about so we can build the case around that target.

Our first real work together rarely happens in a courtroom. It happens at a table with your paperwork spread out between us.

We start with your story. When did you buy the property. When did things start to slip. Was there a job loss, a medical event, a divorce, or a tenant problem. We write that story down in a simple timeline that runs alongside the loan’s history.

Then we pull the numbers apart. We look at your note, mortgage, payment history, escrow changes, and all the “past due” and “late charge” lines that show up on your statements. We compare those numbers to what the foreclosure complaint in Cook County says you owe. You would be surprised how often those do not match perfectly.

Once we have story and numbers in one place, we add the legal milestones. Filing date. Service date. First return date. Answer deadline. Redemption expiration. That master timeline becomes the spine of your defense. In every foreclosure defense case, that is the document we keep coming back to. It tells us where we are, what we have already tried, and what must happen next to keep your options open.

In Cook County foreclosure cases, the homeowners who lose by default are not always the ones with the weakest facts. They are often the ones who let a deadline pass because nobody was watching the calendar.

In our office, every Illinois foreclosure defense file lives on two calendars. One is the court’s electronic docket. The other is our internal case management system. On day one we log:

Before every week starts, we review which foreclosure cases are coming up. That is how we avoid the “I did not know there was court today” panic. If something needs to be filed to protect your position, we get it done before the hearing. If a deadline is coming for a response or a document to the servicer, you hear about it with enough time to act.

This is not glamorous work, but it is essential. Foreclosure defense in Illinois is built on protected deadlines. Once a default judgment or an order of sale is entered because nobody showed up or answered on time, your leverage drops. Our first promise to clients is simple. We will not lose your case because a date slipped past in silence.

After we understand your facts and your calendar, we turn to the heart of foreclosure defense: how to respond to the complaint and what story we want the court to see when it looks at your file.

Sometimes the answer is fairly straightforward. We admit what is clearly true, deny what is not, and raise affirmative defenses where the servicer or investor has created problems with the way your loan was handled. Other times we file motions aimed at the structure of the case itself, such as challenges to standing, service, or the bank’s right to enforce the note.

Here is the key point. We do not check boxes at random. When we choose defenses, we ask three questions. First, does this issue actually matter to your end goal. Second, can we support it with documents or testimony, not just hope. Third, will raising it buy useful time or improve our negotiating position, or will it simply waste energy and credibility. That filter is how we stay strategic instead of filing every argument anyone has ever posted on the internet about foreclosure law.

In our files, strategy is written down. For each case we keep a one page plan that lists your goals, our primary defenses, our settlement targets, and the next three moves we are likely to make if certain things happen. You get a version of that plan in plain English so you are never guessing why we are doing something in court.

When you bring your complaint and loan history to The Bow Tie Attorney, we send you back into the process with a written plan instead of a vague hope that “something” will work out.

Real foreclosure defense in Chicago is never only about court. It is about what the judge is doing, what the servicer is doing, and what you are doing at home, all at the same time.

In practice, that means we often have parallel conversations running. While we are filing pleadings and appearing in the Chancery Division, we may also be:

Our job is to keep those tracks from colliding. If mediation or loss mitigation is active, we make sure the judge knows that and adjust the court schedule when appropriate. If the servicer is dragging its feet, we use the case to push for answers. If a resolution starts to appear, we translate the terms back into how they will affect your life six months from now, not just whether they sound good in the moment.

A South Side family we represented a few years ago is a good example. On paper, their case looked like another Cook County foreclosure heading toward judgment. Behind the scenes, we were coordinating a modification review, filing targeted discovery about escrow treatment, and preparing for a possible short sale. Because those tracks were aligned, they ended up with a sustainable payment and stayed in their home. That outcome did not come from a single dramatic motion. It came from steady, coordinated work across all three tracks.

Every foreclosure defense case reaches moments where the path forks. A judge denies or grants a motion. A modification is approved or rejected. A buyer appears for a short sale. Someone in your family gets a new job in another state. At those decision points, our role shifts from building leverage to helping you use it wisely.

We sit down with the newest information and your original goals. Has anything changed. Is keeping the property still realistic and wise. Would a structured exit with a clean timeline and a better balance sheet actually leave you in a stronger position a year from now. We walk through scenarios in plain language and talk about what they would feel like in real life, not just what the legal documents say.

Sometimes that conversation leads to a hard push at a confirmation hearing or trial. Sometimes it leads to a negotiated judgment, a consent to sale with extra time, or a move into a different property with a lighter payment. Whatever the outcome, the point is the same. Foreclosure defense in our office is not about dragging things out until everyone is exhausted. It is about helping you land in the best available place, with your eyes open, at a pace you can handle.

If you are searching for foreclosure defense in Chicago or anywhere in Illinois and want more than last minute filings, schedule a strategy session with The Bow Tie Attorney and find out whether our approach matches what you need.

The first meeting is mostly about listening and organizing. We review your summons and complaint, recent mortgage statements, any letters from the servicer, and your basic income and expense picture. We build a rough timeline of how you reached this point and identify the immediate deadlines in your Cook County or other Illinois case. By the end of that meeting, you should have a clear sense of your urgent next steps and the general shape of a defense plan.

No. Part of what makes our foreclosure defense practice different is that we are selective about which arguments we raise. We focus on defenses that connect to your goals, that we can support with evidence, and that are likely to matter in front of your judge. Filing every possible theory can make a case look noisy and unfocused. We prefer a smaller set of well supported points that we can explain clearly and press effectively.

Communication is a core part of our strategy. We send written updates after key hearings or filings, and we try to translate court events into normal language instead of legal shorthand. For more complex moves, such as responding to a settlement offer or deciding whether to appeal, we schedule calls or meetings to walk through options together. You should never feel like you have to decode the docket on your own to find out what happened.

Yes. In fact, that combination is at the center of many of our cases. We often defend the foreclosure case in the Chancery Division while also handling a loan modification or other loss mitigation track with the servicer. The court process gives structure and accountability to the review, and the review gives us more settlement options in court. The key is coordination so that deadlines in one track do not undermine progress in the other.

Timelines vary, but many defended foreclosure cases in Cook County run for many months, and some run longer than a year. That time is not automatic, and it is not the main goal by itself. We use the time the system gives us to explore loan modification, short sale, deeds in lieu, and other resolutions that make sense for you. During the case, we keep you updated so the length of the process feels like an asset instead of an uncontrolled delay.

If you want a lawyer who will treat your foreclosure case as a living strategy, not just a line on a docket, we may be a good fit. Our best relationships are with clients who are ready to be honest about their finances, responsive on documents, and open to realistic conversations about what “winning” looks like in their situation. The easiest way to find out is to schedule a consultation. After we hear your story and review your papers, we will tell you honestly whether we think we can help and what that would look like.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney