Private money fuels a huge share of Illinois real estate deals: flips, rehabs, small commercial projects, and bridge loans that banks will not touch on the timeline investors actually need. If you are lending your own capital—or managing a small pool of investor funds—you already know that the return is only as good as your ability to get paid back.

That is where legal structure comes in.

At The Bow Tie Attorney, Mahmoud Faisal Elkhatib helps private lenders and real estate investors treat every loan like a business, not a favor. We move quickly from term sheet to closing, coordinate with title, and build files that can hold up if you ever have to enforce the note or negotiate a workout.

This article walks through how we approach private money lending in Illinois: why structure matters, how we build full documentation, what compliance guardrails look like in real life, and how we work with you so each loan file protects your capital instead of leaving you exposed.

If you are about to fund a flip, rehab, or small commercial deal, The Bow Tie Attorney can turn your term sheet into a full, enforceable loan package before money leaves your account.

Many private loans start with trust. You know the borrower, you like the project, and the numbers look good. That is fine—until something unexpected happens. Contractors disappear, ARVs come in low, municipalities get interested, or the borrower’s personal life changes. In those moments, the only thing between you and a total loss is the structure you built on day one.

Rate and points reward you for taking risk. Legal structure decides whose balance sheet that risk lands on when the deal goes sideways.

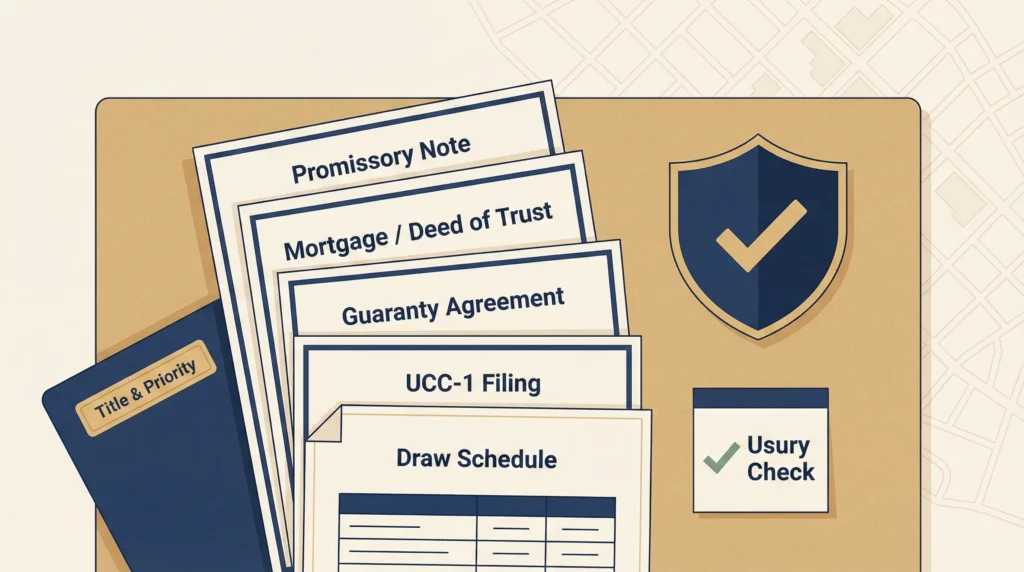

In Illinois, that structure includes more than just a promissory note. It is the mortgage that actually attaches your lien to the property, the guaranty that pulls in the borrower’s other assets if the entity fails, the UCC filings that cover personal property, and the title work that confirms you are in the position you think you are. Mahmoud’s job is to make sure each piece lines up so that if you ever have to enforce, you are not finding out about gaps in real time.

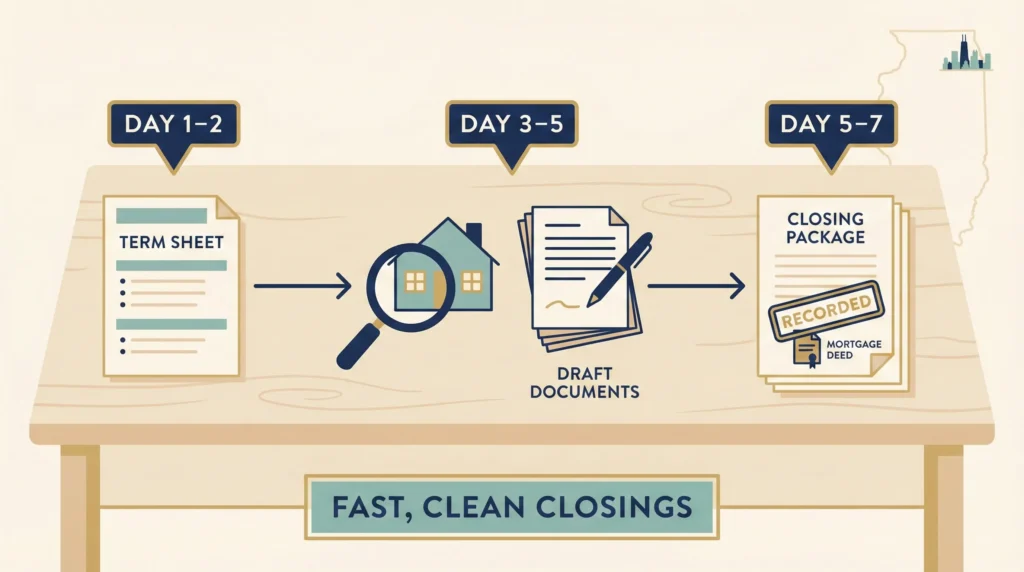

Private money moves on investor time, not bank time. Once you decide to fund a deal, everyone expects the loan to close yesterday. The challenge is closing quickly without skipping the steps that keep you safe.

Our typical process looks like this:

In many residential, small commercial, and rehab deals, that entire arc—from term sheet to recorded mortgage—can happen within three to seven business days when everyone cooperates.

A private loan file is only as strong as its weakest document. Templates pulled from old deals or the internet often leave holes you only see when you are already in trouble.

When we build or overhaul your documents, we focus on:

The aim is a file that tells a consistent story: what you funded, what you are owed, what secures it, and what happens when the borrower does not deliver.

Private money lending still lives inside a legal framework. Even when a loan is business-purpose and made to an entity, you have to watch for usury issues, licensing rules, and consumer overlays that can sneak in when properties involve owner-occupants or mixed uses.

Our guardrails typically include:

These steps are not about slowing you down. They are about preventing the kind of mistake that turns a good loan into an unsecured IOU you might never collect.

The strongest private money deals are fast and clean. The Bow Tie Attorney helps you build compliance and lien protection into your standard process so every loan starts on solid ground.

Every lender has a slightly different style. Some fund a handful of rehab projects a year. Others run private lending as a primary business line. Our service is built to flex with that reality.

In most relationships, the workflow looks like this:

The result is a lending operation that feels more professional, more predictable, and better protected—without losing the speed that made you useful to borrowers in the first place.

The best time to bring Mahmoud into a private money deal is before the first dollar wires out—but even if a loan is already in motion, it is rarely too late to strengthen your position.

You should consider reaching out if:

The Bow Tie Attorney’s job is to step in before a problem becomes a loss, and to give you a clear, legally grounded path forward when things do get bumpy.

If you are serious about private money lending in Illinois, you cannot afford shaky paperwork. A short conversation with The Bow Tie Attorney can help turn your next loan into the standard you use for every deal after it.

Licensing questions depend on who you are lending to, how often you lend, and how the loan is structured. Many business-purpose loans to entities secured by investment property fall outside of traditional consumer lending regimes, but there are still rules to respect. Before you scale up or advertise broadly, it is wise to have your model reviewed so you are not accidentally operating in a regulated space without realizing it.

With a cooperative borrower and a responsive title company, many residential or small commercial private loans can close in three to seven business days from signed term sheet to funding. The key is having your documents, closing process, and title relationships dialed in before a live deal appears. Complex title issues, entity problems, or major rehab components can extend that timeline.

You can, but you may be taking more risk than you think. Old documents may not reflect your current lending terms, may be missing protections you now need, or may not play well with changes in law or market practice. At a minimum, it is smart to have your standard forms reviewed and updated periodically so each new loan does not inherit yesterday’s blind spots.

People use those terms loosely. In many cases, “hard money” refers to higher-rate, asset-focused lending done as a business, sometimes by companies with formal branding and marketing. “Private money” often refers to individuals or small groups lending their own capital. From a legal standpoint, what matters most is how the loan is structured, who the borrower is, what the purpose is, and how often you lend—not just the label you attach to the deal.

Construction and rehab loans require extra care because you are funding work that increases value over time. We typically build in detailed draw schedules tied to milestones, inspection or photo requirements, and retainage or holdbacks to prevent over-advancing. We also coordinate with title to monitor lien waivers and potential mechanic’s lien exposure so you are not funding over hidden risks.

When a loan goes bad, your options depend on the documents, collateral, and facts you started with. That might include sending default notices, charging default interest, negotiating a workout, taking additional collateral, or ultimately enforcing your rights through foreclosure or other remedies. Planning for those possibilities at the front end gives you more leverage and better choices at the back end. If you already have a troubled loan, we can review your file and map out a response that fits your goals and risk tolerance.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney