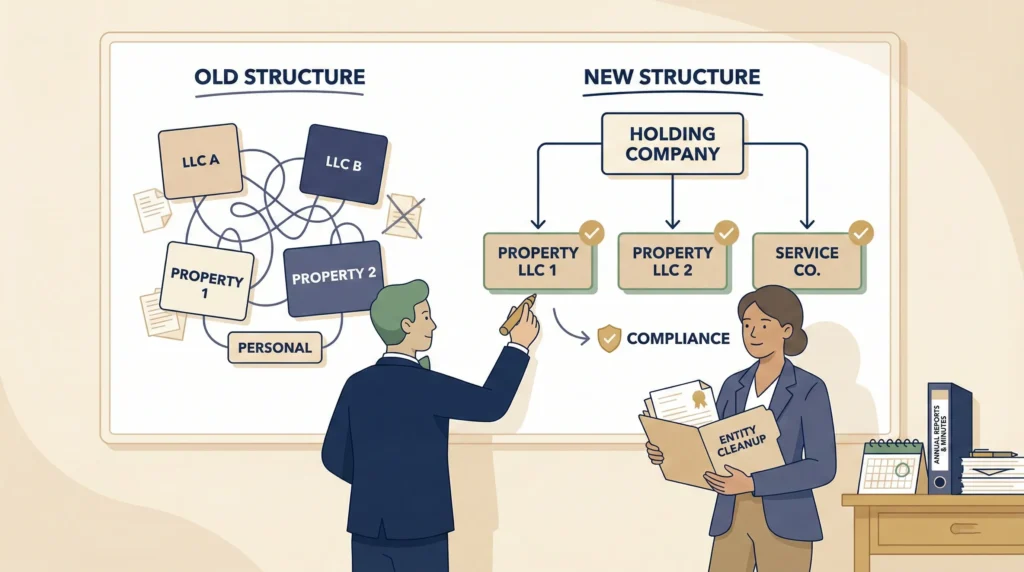

Many real estate investors start the same way: one property, one LLC, one bank account. It feels simple and smart. But as you add rentals, flips, private money, and partnerships, the structure that used to work starts to creak. Some properties end up in your personal name, others in half-finished LLCs, and nobody is quite sure what happens if a deal goes sideways.

That is where corporate and entity work comes in.

At The Bow Tie Attorney, we help Chicago and Illinois investors build legal structures that actually match their business. That means forming and fine-tuning LLCs and corporations, drafting the contracts that govern those entities, and restructuring older setups so your liability, tax planning, and operations all point in the same direction.

This article walks through how we do that work: entity formation for real estate investments, business contract drafting and review, and restructuring and compliance when your business has evolved beyond its original paperwork.

If your properties, LLCs, and partnerships feel scattered, The Bow Tie Attorney can help you map what you have and design what you actually need.

Real estate is a business built on risk. Tenants get hurt, contractors make mistakes, markets turn, and partners change their minds. Entity structure is how you decide who absorbs that risk. A well-designed LLC or corporation separates your investment activity from your personal home, job, and savings. A sloppy structure does the opposite.

Your entity setup should match the size and shape of your investing—not just whatever someone filed for you years ago.

For some investors, one well-run LLC is enough. For others, especially with multiple partners, properties, or lines of business, a more layered structure makes sense. The point is not to collect entities like trading cards. It is to use them intentionally so your deals, bank accounts, insurance, and contracts all support the same plan.

Forming an entity is more than clicking “file LLC” on a website. For investors, it is about aligning your structure with how you actually buy, hold, and exit deals.

When The Bow Tie Attorney sets up an entity, we look at:

From there, we help you choose between LLCs, corporations, and series or holding structures, and we draft the filings and foundational documents so the entity is more than just a name on the Secretary of State’s website.

Most real estate disputes are really contract disputes. Someone thought a deal meant one thing; the paperwork says another.

We help investors draft and review the agreements that keep their operations running, including:

Our goal is to keep you out of court by making your contracts easy to follow and hard to fight about.

As your portfolio grows, your original structure may stop fitting. Maybe you formed multiple LLCs and never used them, or ran everything through one entity that now owns too much. Maybe annual reports, minutes, and tax filings fell behind.

The Bow Tie Attorney helps investors:

The result is not perfection on paper. It is a structure you can actually explain—and rely on when something goes wrong.

If your entities, contracts, and bank accounts do not match the way you really operate, a short review with The Bow Tie Attorney can help you tighten things up before the next big deal.

Entity and corporate work does not have to be abstract. In most investor files, the process follows a clear path.

Typically, we:

The focus is always the same: a structure that protects you without slowing your business to a crawl.

You do not need a hundred doors to justify cleaning up your entities. The right time to call The Bow Tie Attorney is when your gut tells you that the business has outgrown the quick fixes.

That might be when:

A short conversation now can save you years of explaining later.

If your real estate business has become more complicated than your paperwork, it is time to align the two. The Bow Tie Attorney can help you build or rebuild a structure that fits the way you actually invest.

Not always. Some investors benefit from one entity per property; others are better served by grouping certain assets or using a holding structure. The right answer depends on your risk tolerance, lender requirements, insurance, and tax planning. Our job is to walk through those factors with you so you are not just copying someone else’s structure from an online forum.

LLCs offer flexible ownership and tax treatment and are often the default choice for small and mid-size real estate operations. Corporations can make sense for certain active businesses or where you plan to bring in employees, stock structures, or outside investors. The key is how income will be taxed, how profits will be split, and how formal you want corporate governance to be. We help you pick the tool that fits your specific deals.

Often yes, but you have to be careful. Deeding property into an entity can trigger loan due-on-sale clauses, affect insurance coverage, and have tax consequences. Before you move anything, we review your mortgages, title, and overall plan so you do not create new problems while trying to solve old ones.

At a minimum, most investors need solid operating or partnership agreements, clear purchase and sale templates, written joint venture or private money agreements, and, if they use managers or vendors, written management and service contracts. The exact list depends on how you invest, but the theme is the same: important relationships should not live only in text messages.

A quick review every year or two, or after any major change in your business, is usually wise. If you have added properties, partners, or new types of deals since your last review, that is a strong signal that your structure should be revisited. The cost of small, regular adjustments is almost always lower than the cost of one big cleanup after something has gone wrong.

Yes. Some of the best results come when legal, tax, and accounting advisors are on the same page. We are happy to coordinate with your existing professionals so that your entity structure and contracts support both your legal protection and your tax strategy.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney