In Chicago, buying or selling property is supposed to be exciting—new keys, new space, a new chapter. But if you have ever sat through a stressful closing, you know how quickly that excitement can turn into confusion. Pages of documents appear. People slide papers across the table telling you, “Sign here, it is standard.” You nod along and hope everyone is right.

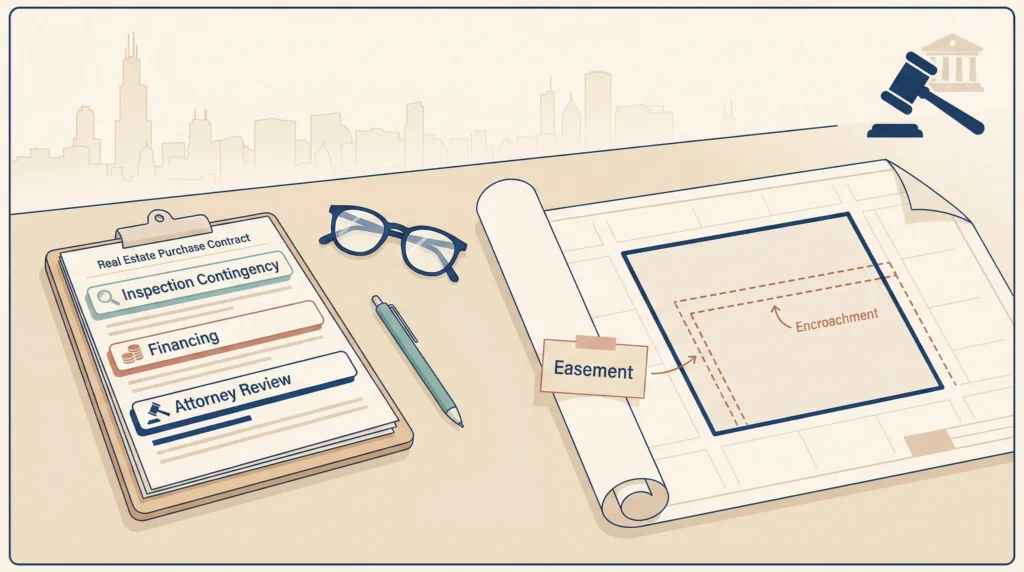

Real estate law is what happens when someone on your side refuses to treat your deal as “standard.” It is the work of reading the contract before you sign, making sure title is actually clean, catching the problem survey, and pushing back when the other side quietly shifts risk in your direction.

At The Bow Tie Attorney, we handle real estate the way we handle litigation: deal-first, detail-obsessed, and grounded in real Chicago practice. Whether it is a South Side two-flat, a downtown condo, a mixed-use building, or a small commercial space, our job is to protect your interests so that the closing you remember is the day you got the keys—not the day a problem started.

This article walks through how we approach Illinois real estate work: residential and commercial closings, contract review and negotiation, and title and boundary issues. The goal is simple: show you what it looks like to have a lawyer who treats your deal like a real file, not just a stack of papers to stamp.

If you are under contract on a property in Chicago or anywhere in Illinois, you already know the numbers matter. Price, taxes, rent roll, rehab budget—everyone talks about those. The part most people do not talk about is the paperwork that quietly controls what happens if the numbers are off.

Real estate law is more than just being present at the closing table. In a typical Chicago transaction, your lawyer may be involved in some or all of the following:

Done well, real estate work is quiet. The best compliment we get is when clients say the closing felt easy—because they know how much work went into making it look that way.

In our office, that quiet is built on checklists, timelines, and real communication. We track key dates, document requests, and lender milestones so you do not have to constantly wonder, “Is anyone paying attention to this file?” From the first draft of the contract to the last signature at closing, our focus is the same: keep your deal moving while protecting your downside.

Whether you are buying your first condo, selling a family home, or closing on a small commercial building in Cook County, the closing is where every moving part meets: contract, title, taxes, lender, insurance, and practical move-out or move-in issues.

Our closing work typically includes:

For commercial deals and investment properties, we layer in additional questions: leases, rent rolls, zoning, environmental issues, and how the property fits into your broader portfolio and risk tolerance. The paperwork changes, but the principle is the same—no surprises when money and keys change hands.

Too many people sign real estate contracts the way they sign online terms of service: scroll, initial, hope for the best. In Chicago, that is how buyers and sellers end up stuck with one-sided inspection provisions, vague repair language, or remedies that do not match reality.

When we review a contract, we are looking for the places where real deals actually break:

Our goal is not to turn every deal into a fight. It is to make sure the written contract actually matches the deal you think you have—and to fix the pieces that would hurt you most if things go sideways.

Title work and surveys are where buried problems live. A recorded easement, an old mortgage that was never properly released, a missing probate, or a garage that sits six inches over the lot line can all turn a normal closing into a mess—or into a lawsuit years later.

When we review title and survey materials, we focus on:

Sometimes these issues can be solved with releases, endorsements, or minor adjustments. Other times, they require negotiation or even litigation. Our job is to spot them before you close so you are not the one paying to fix a problem that should have been someone else’s responsibility.

The cheapest time to solve a title or boundary problem is before you close. Once you own the property, you also own the headache—and the bill.

On your side of the table, a well-run closing should feel organized, respectful of your time, and predictable. Behind the scenes, there is a lot going on.

In a typical file, our closing process looks like this:

The result is not perfection—real estate has too many human pieces for that. The result is a process where surprises are rare, questions are answered, and you feel like someone is watching the details so you can focus on the bigger picture.

The best time to bring a real estate attorney into your deal is before you sign anything. The second-best time is now.

If you are:

That is the moment to reach out. We will not scare you out of every deal or greenlight everything without comment. Our job is to help you understand the risk and decide whether this property, on these terms, fits the life and business you are trying to build.

Your real estate transaction is not just another file. It is your home, your investment, or your next move in Chicago’s market. The paperwork you sign today decides how that story reads five or ten years from now.

If you want a lawyer who treats your closing with the same seriousness you do, schedule a Real Estate Strategy Session with The Bow Tie Attorney.

In many Chicago-area transactions, having a lawyer is not just helpful; it is expected. Even in a straightforward condo or single-family purchase, there are contract terms, title issues, lender requirements, and municipal rules that can affect your rights long after closing. A good attorney adds more value in preventing problems than in fixing them later—especially when the cost is usually a flat fee compared to the size of the deal.

Your agent focuses on finding the property, negotiating price and basic terms, and keeping the deal moving from a market perspective. Your lawyer focuses on the legal and risk side: contract language, deadlines, title, surveys, closing documents, and what happens if something goes wrong. The best files are the ones where the agent and lawyer work together, each doing what they are trained to do.

As soon as possible after it is signed—ideally the same day. Most standard Chicago contracts include a short attorney review period, often five business days. That window is your chance to propose changes, clarify terms, or even cancel if serious issues arise. Waiting until the last day, or after the period has expired, limits what we can do for you.

At a minimum, we review the signed contract, the title commitment and exception documents, the survey (if required), association documents for condos or HOAs, lender instructions and the closing disclosure or settlement statement, and any addenda or side agreements. In commercial or investment deals, we may also review leases, rent rolls, zoning letters, environmental reports, and corporate documents.

Most residential closings are handled on a flat-fee basis that covers standard services from contract review through closing and routine post-closing follow-up. If your file involves unusual complexity—such as significant title defects, multiple liens, or related litigation—we will discuss that with you up front so you are not surprised. Either way, you will know how we are billing and what is included before we get deep into the file.

If you discover an issue after closing, all is not lost—but your options depend on the facts. We may look at whether the problem was disclosed, whether title insurance should respond, whether the seller breached any representations, and whether municipal or neighbor issues can be resolved informally. The stronger and clearer your closing paperwork is, the better your chances of a clean resolution. That is another reason to invest in careful review on the front end.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney