The moment you realize you have missed a mortgage payment, it can feel like a trap door just opened under your life. You start imagining sheriffs at the door, instant foreclosure, ruined credit, and a clock you cannot see ticking in the background.

In real Illinois files, that is not how it works. Most servicers move through a quieter first phase: your payment is marked late, fees start to accrue, automated letters and calls go out, and your loan falls onto a different internal screen. For a while, nobody has filed a lawsuit. Nobody has scheduled a sheriff’s sale. From the outside, it may look like nothing is happening.

That quiet early phase is exactly when you have the most power to change the trajectory of your file.

This article explains what typically happens after you miss your first mortgage payment in Illinois and gives you a simple, seven-day action plan. The goal is not to scare you. The goal is to move you from vague panic to specific steps—so you can decide whether this is a one-month problem you can fix or the start of a bigger foreclosure story that requires a real strategy with The Bow Tie Attorney.

Missing a mortgage payment is scary. Ignoring it is worse. The servicer’s systems are already logging fees, flags, and risk codes—even if nobody has said the word foreclosure to you yet.

In a Week-One Mortgage Triage Session, we review your most recent statement, your budget, your late notices, and what your servicer has already done. Then we map out whether you are catching up, restructuring, or preparing for a longer fight, so the next thirty to sixty days are driven by a plan instead of by whatever letter shows up next.

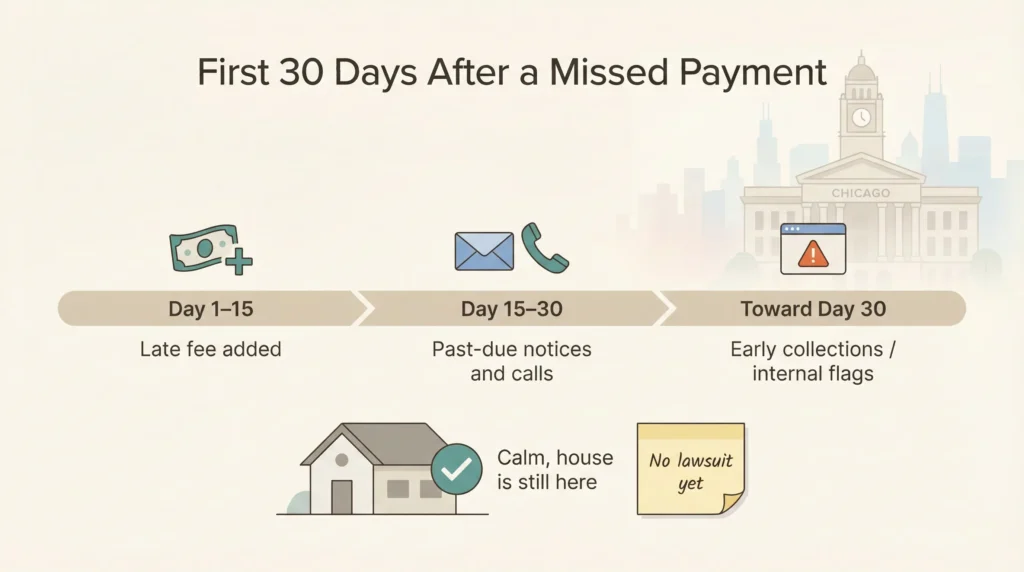

Most homeowners picture a straight line from one missed payment to a foreclosure sale. In reality, there are stages. In the first thirty days after you skip or underpay a mortgage payment in Illinois, your servicer typically does a few predictable things:

What usually does not happen immediately is a lawsuit. Judicial foreclosure in Illinois takes time and specific steps. The fact that the courthouse is not involved yet does not mean your first missed payment is harmless. It means you are still in the part of the story where your choices have the most leverage.

The gap between your first missed payment and the moment a foreclosure case is filed is where you can do the most good with the least drama—if you use that time intentionally.

Servicers and investors are not all the same, but they have patterns. Some are quick to push files toward legal action; others move more slowly. Some are flexible with repayment options when you reach out early; others are rigid. You cannot control which servicer you have, but you can control whether you are organized, informed, and proactive in week one instead of waiting for the red-letter mail to pile up.

From the outside, nothing catastrophic usually happens in the first seven days after a missed payment. Your kids still go to school. You still go to work. No one has posted anything on the door. That lack of immediate drama is exactly why so many homeowners do nothing in week one—and then feel trapped three or six months later.

Inside the servicer’s system, however, week one is when your loan shifts from normal to needs attention. That shift changes how your account is routed, who sees it, and how future calls and letters are handled. It also changes how much pressure you feel at home.

Using the first week well is not about becoming a legal expert overnight. It is about doing a handful of simple things that make every later conversation easier: understanding your numbers, gathering documents, writing down dates, and deciding whether you are trying to cure the problem quickly or need a deeper restructuring plan.

The first two days after you realize you missed a payment are about getting your arms around the facts. You cannot fix what you will not look at.

Here is what to do—and what to avoid—in those first forty-eight hours:

By the end of day two, you should have a small but real picture: what you owe right now, how long it has been, and where your paperwork lives.

Once you know your numbers, the next step is usually a focused call with your servicer. The goal is not to pour your heart out to a call-center rep. The goal is to collect specific information and, if possible, start a paper trail that shows you are engaging early.

Before you call, make a one-page sheet with:

During the call, write down the date, the name or ID of the person you spoke with, and what they said. If they mention specific programs, deadlines, or forms, note those too. Afterward, put your notes in your mortgage folder. If the servicer has an online portal, consider sending a short message summarizing what you understood from the call, so there is a record in their system.

What you should not do is make promises you are not sure you can keep just to end an uncomfortable conversation. Telling a servicer you will be current in ten days when you know that is unlikely can create more pressure later. Be honest about your situation—even if that honesty is uncomfortable.

A single missed payment does not define you. What you do next starts to. You can let the late notices pile up and hope for the best, or you can decide that week one is when you stop guessing and start planning.

In a First-Missed-Payment Strategy Session, we look at your loan, your budget, your servicer’s likely moves, and what you want for your home and your family. Then we outline whether you are aiming to catch up, restructure, or plan an eventual exit—and what each path really looks like over the next three to twelve months.

By the end of the first week, the goal is not to have your whole future figured out. The goal is to have moved from panic to a short written plan you can actually follow.

A simple week-one checklist might look like this:

Writing these pieces down is not about being perfect. It is about shifting from this is happening to me to I am actively managing what happens next.

Most people do not call a lawyer until they see the words foreclosure or sheriff’s sale on paper. By that point, important decisions have already been made by default. When we are brought in during the quiet first phase—after a missed payment or two, before a lawsuit—we can do much more with far less chaos.

In that early stage, our work often includes:

The point is not to make your life more legal than it needs to be. The point is to make sure that if this missed payment does turn into something larger, you are walking into that next phase with a file and a strategy you are not ashamed of.

By the time a sheriff is at your door with a summons, your missed payments are no longer a quiet problem. They are a lawsuit. You still have options then—but you had more options earlier.

If you have just missed your first mortgage payment in Illinois, or you see that you are about to, schedule an Early-Stage Foreclosure Defense Strategy Session with The Bow Tie Attorney. We will look at your numbers, your servicer’s patterns, and your goals so that whatever happens next, it is happening with you in the driver’s seat.

No. One missed payment does not automatically trigger a foreclosure lawsuit. In Illinois, foreclosure is a legal process that takes multiple steps and usually follows a pattern of missed payments, notices, and internal review at the servicer. That said, the first missed payment starts the clock and can lead to fees, credit damage, and a higher risk of foreclosure if the problem is not addressed. Treat it as an early warning light, not something to shrug off.

Credit reporting practices vary, but many mortgage servicers do not report you as late to the credit bureaus until you are a full 30 days past due. That means if you catch up quickly enough, you may be able to avoid a major hit. Once a 30-day late is reported, it can stay on your credit report for years, even if you later bring the loan current. That is another reason week one matters: the sooner you address the problem, the more options you have to protect your credit profile.

It depends. Using every dollar you have to fix one month’s payment without a realistic plan for next month can leave you broke and still behind. Raiding retirement accounts can also create tax penalties and long-term damage. Before you empty savings or tap into retirement to fix a shortfall, it is wise to step back and look at the bigger picture: is this a temporary glitch or a structural problem? Part of our job is to help you think about the whole arc of your finances, not just this month’s crisis.

That feeling is more common than you think. Many people freeze when they fall behind. The risk is that silence can be misread by the servicer as indifference or avoidance. If you truly cannot bring yourself to make the first call, consider asking a trusted person to sit with you while you call, or reaching out to counsel so we can help you prepare and, in some cases, communicate more effectively on your behalf. The key is to break the silence in a way that still protects your rights.

You are not required to hire a lawyer just because you missed a payment. Many short-term hiccups can be managed directly with the servicer. You should strongly consider getting legal advice, though, if you already know the problem will last more than a month or two, if your income has changed significantly, if you are juggling other serious debts, or if you are getting letters you do not understand. Early advice is usually cheaper and more effective than emergency help later.

Yes. The label on the article says “first missed payment,” but the week-one plan still works if you are a few months behind and just now facing the reality of it. You may have fewer options and tighter timelines the further behind you are, but the steps—organize, understand your numbers, communicate intentionally, and get advice—remain the same. The most important move is deciding that this is the week you stop pretending it will magically fix itself.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney