By the time many Illinois homeowners talk to us, they have already had the hardest conversation at home: we cannot keep this property long term. The payment is not sustainable, the repairs are too big, the job or family situation has changed, or the numbers simply do not work anymore.

Once that reality sinks in, a different question takes over: If we cannot save the house, how do we get out of this in the smartest way possible?

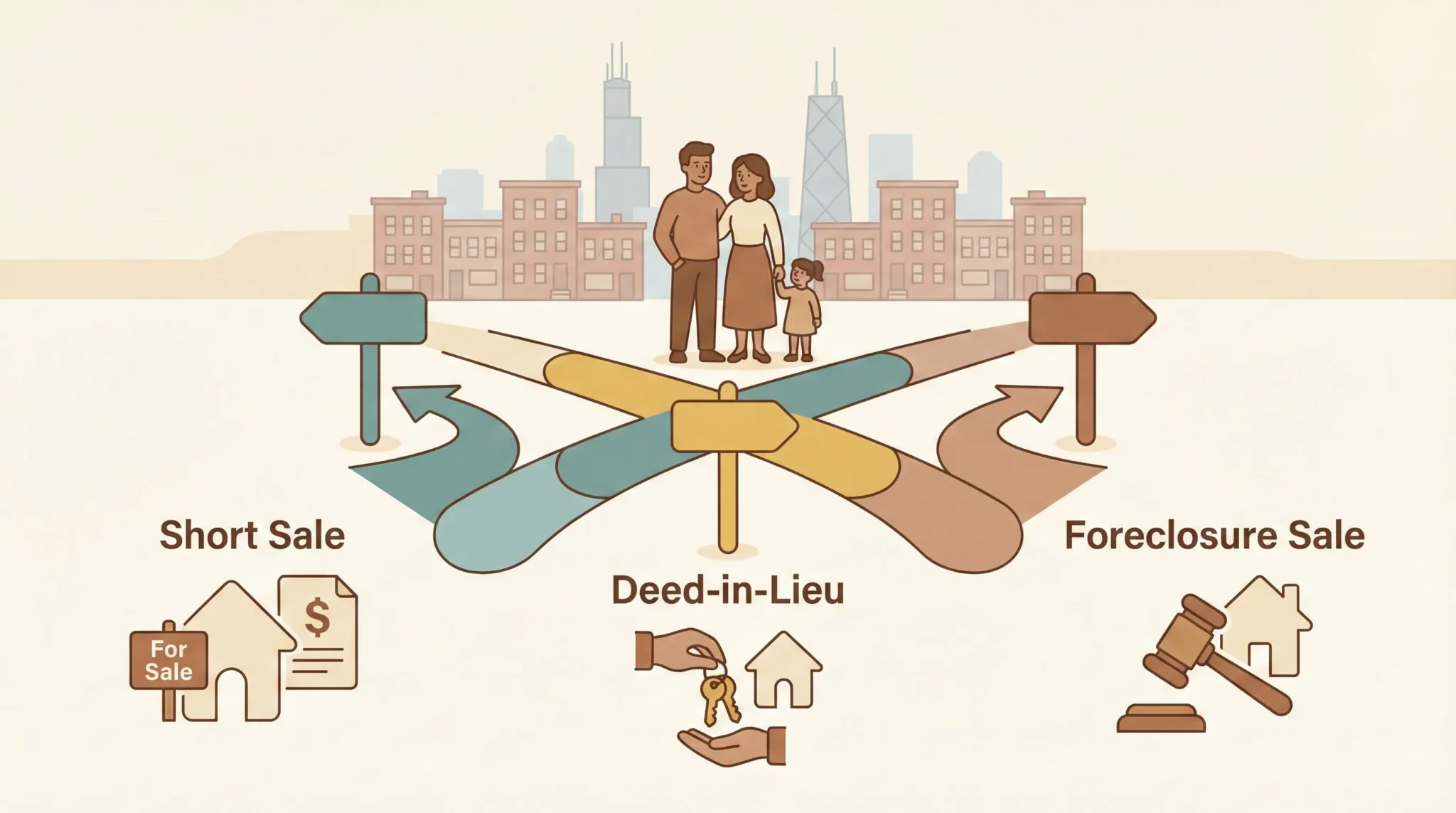

That is where three paths usually come up in real files: a short sale, a deed-in-lieu of foreclosure, or simply letting the foreclosure case move forward to a judicial sale and dealing with whatever comes next.

This article compares those three options in plain English. We will talk about what each path means practically, how they usually feel for real families going through them, and how we evaluate buyer strength, deficiency exposure, tax issues, and timing. The goal is not to crown one winner. The goal is to help you see which lane might fit your larger financial and family goals so you are not making a life decision based on a rumor or a Facebook comment.

If you already know you are not keeping the house, you are not failing—you are making a hard but honest decision. The next step is making sure that decision turns into a strategy, not just a series of deadlines you do not control.

In an Exit Strategy Session, we look at your loan, your foreclosure posture, your buyer or lack of buyer, and your bigger financial picture. Then we walk through short sale, deed-in-lieu, and letting it go to sale as real options, not buzzwords, so you can choose a path that makes sense for this chapter and the next one.

Every foreclosure story starts with the question, can we save this house? For some families, the answer is yes—with a modification, a plan, or a refinance. For others, the math or the life circumstances never quite line up. No amount of legal creativity can turn a fundamentally unworkable payment into a safe long term plan.

Admitting that you are not going to keep the property is not quitting; it is shifting the mission from saving this house at all costs to protecting your credit, your cash, and your family for the next place you will live.

Once you cross that line, the legal tools look different. Instead of asking how do we stop the sale, you start asking questions like: Is there a buyer we can work with? Will the lender talk about a deed-in-lieu? What happens if we simply let the sale go through? Each path can be right in the right file. Our job is to help you see them clearly so you can decide with your eyes open rather than drifting into whatever happens first.

A short sale is a sale where the property is worth less than the total debt, and the lender agrees to accept that lower sale price in exchange for releasing its lien. In real life, that means you work with a buyer and an agent to put the property under contract, then your lender reviews the offer and either approves, counters, or rejects the deal.

On the ground, a short sale can make sense when:

The tradeoffs are that short sales take work. There are showings, paperwork, lender packages, and a review process that can drag. Some buyers lose patience. Some lenders are slow or inconsistent. You are still in the middle until the closing actually happens. When they work, though, short sales can give you a cleaner narrative and, in some cases, better control over deficiency and tax outcomes.

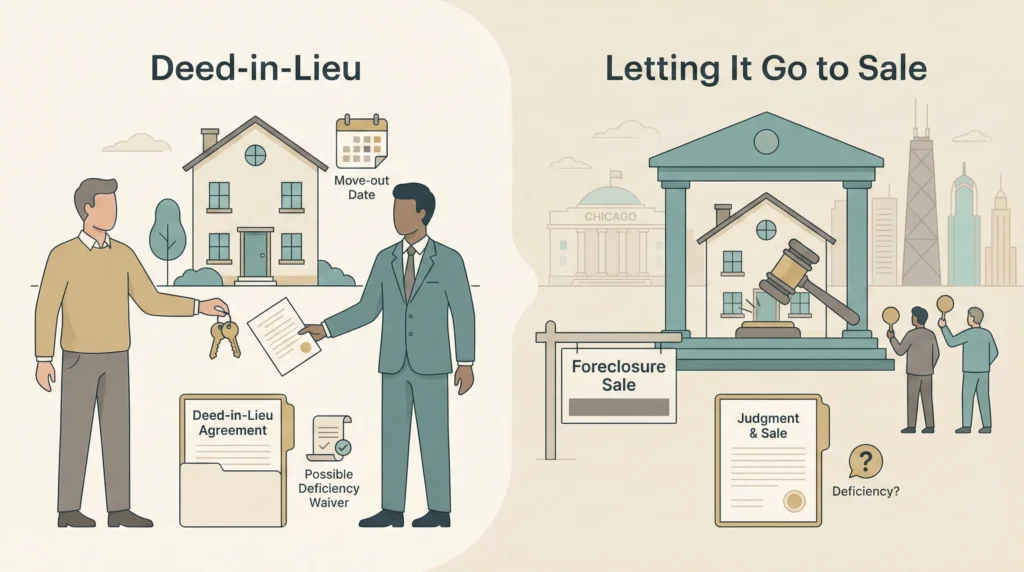

A deed-in-lieu of foreclosure is exactly what it sounds like: instead of forcing the lender to finish the court case and hold a sheriff’s sale, you sign a deed transferring the property back to the lender (or its designee) in exchange for an agreement about what happens to the debt.

On paper, a deed-in-lieu sounds simple. In practice, there are traps:

When the file fits, a deed-in-lieu can be faster and more dignified than riding the whole way to a sheriff’s sale. But it is only a good deal if the paperwork protects you from surprises on the back end.

For some homeowners, especially when there is no buyer and the lender is not interested in alternatives, the path of least resistance is to let the foreclosure case continue to a judicial sale. That usually looks like this in real life:

Letting it go to sale can feel passive, but it is still a decision. In some cases—especially where the property is heavily underwater, in poor condition, or tangled in other liens—there may be no realistic short sale or deed-in-lieu option. In others, letting the sale proceed might make sense if you are prioritizing time in the home and a clean break later over the work of coordinating an alternative exit.

The big question we always overlay is what happens with any potential deficiency, and how this path fits with your plans for credit rebuilding, renting or buying again, and your family’s move timeline.

Short sale, deed-in-lieu, or letting it go to sale are not three different flavors of the same outcome. They can lead to very different stories on your credit, different timelines for moving, and different levels of risk on any remaining balance.

In a Three-Path Exit Review, we line up these options side by side for your actual file: your lender, your equity, your income, your family’s needs. Then we talk through what each route would look like over the next 6–24 months so you can choose on purpose instead of waking up one day and realizing the court chose for you.

When we sit down with an Illinois homeowner who is not keeping the property, we are not just picking our favorite legal tool. We are running your file through a few practical filters.

Some of the questions we ask include:

Put together, those answers tend to point toward one option making more sense than the others. There is no magic formula, but there is a disciplined way to compare the paths so you are not relying on guesswork.

At the end of the day, short sale vs. deed-in-lieu vs. letting it go to sale is not a law school exam question. It is a family decision with legal tools attached. The paperwork matters a lot—but so do the people.

When we work with Illinois homeowners on exit strategies, we talk about:

Our job is to bring the law, the lender, and the court calendar into that conversation without letting them drown out what actually matters to you. When those pieces are aligned, the exit may still be hard—but it does not have to be chaotic.

Short sales, deeds-in-lieu, and foreclosure sales are not abstract concepts for other people. If you are in an Illinois foreclosure and know you are not keeping the house, they are the actual doors in front of you.

If you want to understand what is behind each door for your file—your lender, your numbers, your family—schedule a Three-Exit Strategy Session with The Bow Tie Attorney. We will walk through your options like we would with our own relatives: with honesty, strategy, and respect for the life you are building on the other side.

Short sales and foreclosures both show up negatively on your credit, but the details matter. In some cases, a successfully completed short sale may be viewed slightly more favorably by some lenders than a full foreclosure, and it may position you to qualify for certain types of future financing sooner. In other files, the impact is similar. What often matters more is whether the debt is resolved cleanly, whether there is a deficiency, and what your credit picture looks like overall. We look at your full situation before promising that one path is automatically better on credit alone.

No. Many people assume that handing the keys back automatically cancels the debt. In reality, it depends on the language of the deed-in-lieu agreement and the court orders in your case. Some agreements include a full deficiency waiver, some only waive as to certain parties, and some leave the door open for collection. Reading the actual documents—not just the label—is critical before you rely on a deed-in-lieu to clear your balance.

Not every foreclosure sale in Illinois leads to active collection on a deficiency. Whether the lender pursues a deficiency judgment or tries to collect on it depends on factors like the size of the shortfall, your income and assets, the lender’s policies, and how the case was resolved. That said, the legal possibility of a deficiency is real. Part of our job is to help you understand how big that risk is in your file and whether an alternative exit could address it more directly.

Letting the foreclosure proceed to sale and then through the post-sale process can sometimes keep you in the property longer than a short sale or deed-in-lieu, especially if there are delays in the court system. But it is not just about time in the house. You also have to weigh stress levels, uncertainty, and what is happening with any potential deficiency along the way. Sometimes, a shorter but more controlled exit is healthier for you and your family than dragging things out.

In some situations, when a lender forgives part of a mortgage debt in a short sale or deed-in-lieu, it may issue a Form 1099-C for cancellation of debt, which can have tax consequences. There are also exceptions and exclusions that may apply based on how the property was used and your broader financial circumstances. We flag these issues and often recommend that you talk with a tax professional as part of your exit planning so the IRS does not become an unexpected fourth player in your story.

The best time is when you first realize that keeping the property is unlikely—not two weeks before a sale. Earlier conversations give us more time to explore buyers, negotiate with the lender, and position your case for a short sale, deed-in-lieu, or managed sale that fits your goals. Even if you are already late in the process, it is still worth talking through your options so your last moves are intentional rather than reactive.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney