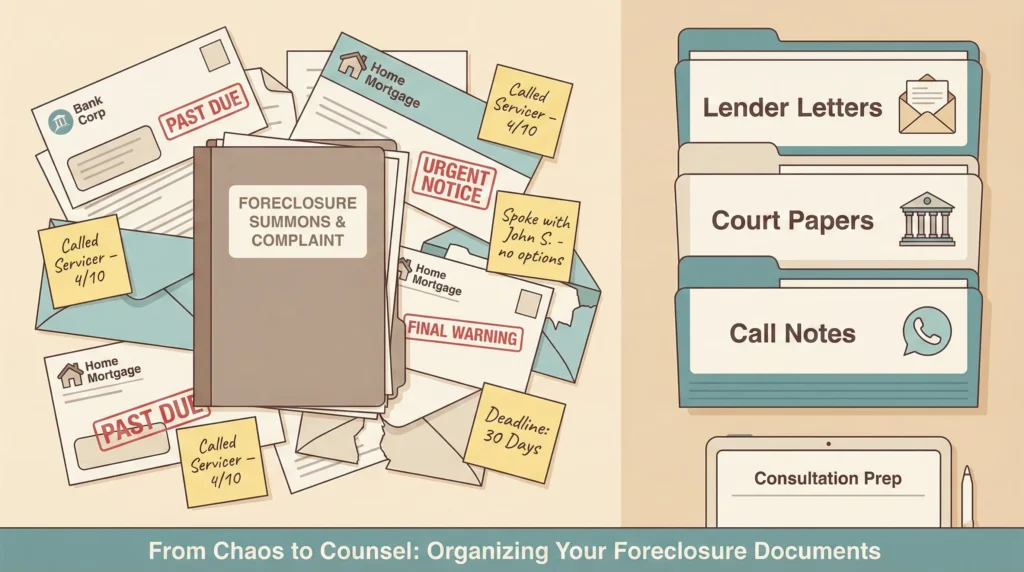

Most Illinois homeowners wait far too long to call a foreclosure defense lawyer. By the time they pick up the phone, they are flooded with letters, online threats, and half remembered advice from friends. The fear is not just about losing the house; it is also about sounding unprepared when someone finally asks for dates, numbers, and documents.

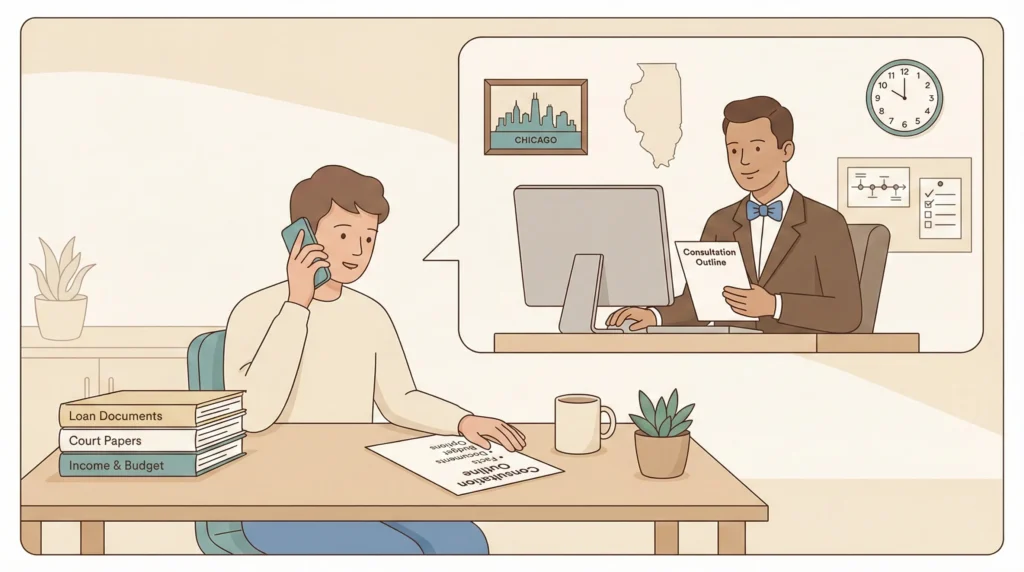

The truth is that you do not need a perfect file before you talk to The Bow Tie Attorney. But bringing a focused set of information to that first call makes a huge difference. It allows us to move quickly from basic intake questions to real analysis: how far behind you are, what the lender has already done, where your Illinois foreclosure timeline sits, and which paths are realistic for your income and your goals.

This article lays out what to bring to your first call with a foreclosure defense lawyer in Illinois. We will cover the core loan documents, letters and notices, any court papers, income and budget information, and a simple written timeline. The goal is not to impress your lawyer with a three ring binder. The goal is to show up as an organized partner so we can spend less time guessing and more time planning.

If you are about to pick up the phone and call a foreclosure defense lawyer, you already know the stakes. The question is whether that first call will be a vague story about being behind or a focused look at your actual file.

In a File Ready First Call with The Bow Tie Attorney, you bring the documents from this checklist and we bring the courtroom and deal perspective. Together we can see how your loan, your court case, and your budget line up under Illinois law and decide whether you are fighting to keep, restructuring, or planning a managed exit.

There is a big difference between calling a lawyer to say I am in trouble and calling with a clear picture of your loan and your case. When we can see your mortgage statement, your delinquency history, and your court papers on day one, we can start answering better questions: How urgent is this really? What options fit your income? Where are the landmines in this particular file?

Preparation is not about being a perfect client. It is about giving your lawyer a clean, honest snapshot of your situation so they can spend the first call thinking like a strategist instead of like a detective.

Showing up prepared also changes the dynamic of the relationship. When you have taken the time to print or download statements, gather letters, and jot down dates, you are sending a clear signal that you respect your own time and the lawyer's time. That makes it easier for us to be direct with you about risk, timing, and cost, and to build a plan that fits the reality of your life rather than a theory of how foreclosure is supposed to go.

Start with the paperwork that shows what kind of loan you have and how far behind you are. For most Illinois homeowners that means:

If you cannot find every single item, do not panic. The goal is to give your lawyer enough to see how the loan is structured and how the numbers have moved over time.

After the core loan documents, the next most valuable pile is the stack of letters and legal papers you have been receiving. These tell the story of what the lender and the court have already done and what they are planning to do next.

For your first call, try to gather:

The most common trap is throwing away envelopes or burying them in a drawer because they are scary. Your lawyer is not judging you for having a stack of unopened mail. We would rather open it together and see what is really going on than guess.

Foreclosure defense is not just about what the bank did. It is also about what you can realistically afford now and what has happened in your life over the last few years. That is why we ask about income, expenses, and timing on the first call.

Before you dial, try to pull:

This information does not have to be perfect. It just needs to be honest. With it, we can quickly see whether your goals line up with your budget and which tools under Illinois law are worth discussing seriously.

A consultation is not just a chance to tell your story. It is a chance to make decisions. The more organized you are when you walk in, the more ground we can cover and the more specific we can be about risk, timing, and cost.

If you want your first meeting to feel like a working session instead of an intake interview, use this checklist and schedule a Prepared Client Strategy Session with The Bow Tie Attorney. We will treat your file like the live deal and live case that it is.

Knowing what will happen on the call can make it easier to gather what you need and actually make the appointment. Every lawyer is different, but here is how we typically run an initial foreclosure defense call in our office.

You do not have to decide everything on that first call, but you should walk away with a clearer picture of what is possible and what it will take to get there.

When you show up prepared, our job becomes much more precise. Instead of guessing about dates and balances, we can start modeling your case and your deal from day one. In practical terms, we use the information you bring to:

The more complete the picture you give us at the start, the faster we can move from fear and guesswork to an actual strategy for your Illinois home.

You cannot control everything in a foreclosure, but you can control how prepared you are when you ask for help. Bringing the right documents and a short timeline to your first call tells your lawyer that you are ready to work.

If you are in Illinois and want to know where you really stand before things move further, schedule a Prepared Client Strategy Session with The Bow Tie Attorney. We will read your file, explain your options, and map out the next steps with you instead of for you.

Almost no one has a perfectly organized file when they reach out for help. Bring whatever you can find quickly, especially your most recent mortgage statement, any foreclosure papers, and a few key letters. During or after the call, we can help you request missing documents from your servicer, your prior lawyer, or the court. Do not wait months to call just because your folder is not perfect.

Either format is fine. Many clients email or upload PDFs of statements, letters, and court documents before the consultation so we can review them in advance. Others bring a physical folder to an in person meeting. What matters most is that the documents are complete and legible, not whether they are on paper or a screen.

If you decide to hire us, your documents become part of your client file and we will store them securely according to our retention policies. If you decide not to move forward, we will either return physical documents to you or delete electronic copies after a reasonable period. You are always welcome to keep your own copies of everything you provide.

Foreclosure work is about real life, not perfection. We see people who have dealt with job loss, medical issues, divorce, business failures, and every kind of financial curveball. Our job is not to judge you; it is to understand the facts so we can help you make a plan. Being honest with your lawyer about your finances and past choices is often the fastest way to get unstuck.

Yes, as long as you are comfortable sharing confidential information in front of them. Many homeowners bring a spouse, adult child, or trusted friend to help listen, take notes, and ask questions. If there are sensitive topics you would rather discuss privately, you can let us know and we can plan a portion of the call or meeting just for you.

The sooner you talk with counsel, the more options you usually have. If you have received a notice of default, intent to accelerate, or a foreclosure summons, it is smart to reach out within days, not weeks. That gives us time to review your documents, calculate any critical deadlines, and help you decide whether you are responding, negotiating, or preparing for other outcomes under Illinois law.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney