When a Cook County sheriff or private process server hands you a foreclosure summons, it can feel like the ground just moved under your feet. Most people see the words You are summoned and assume the judge has already decided the case and the house is already gone.

In real Cook County foreclosure files, that packet means something more precise. It is the court’s formal notice that your lender has filed a lawsuit against you in the Chancery Division, Mortgage Foreclosure Section under the Illinois Mortgage Foreclosure Law. It is serious, but it is also structured: the form tells you which court you are in, how much time you have to respond, and what can happen if you ignore it.

This article walks through the Cook County mortgage foreclosure summons line by line in plain English and then turns it into a seven-day checklist. The goal is simple: move you from I have no idea what this means to I know what this is, what the next 30 days look like, and what I am doing this week to protect my options before a judgment of foreclosure is ever entered.

If a sheriff was just at your door and you are staring at a Cook County mortgage foreclosure summons, you do not need a generic article about foreclosure in America. You need someone who reads these forms every day in the Chancery Division and can tell you exactly what that paper means for your file.

In a Summons Triage Session, we review your summons and complaint, identify your 30-day deadline and any first case-management date, look at your arrears and budget, and map out your realistic options under Illinois law and Cook County procedures before the clock quietly runs out. You bring the packet; we bring the courtroom and deal context.

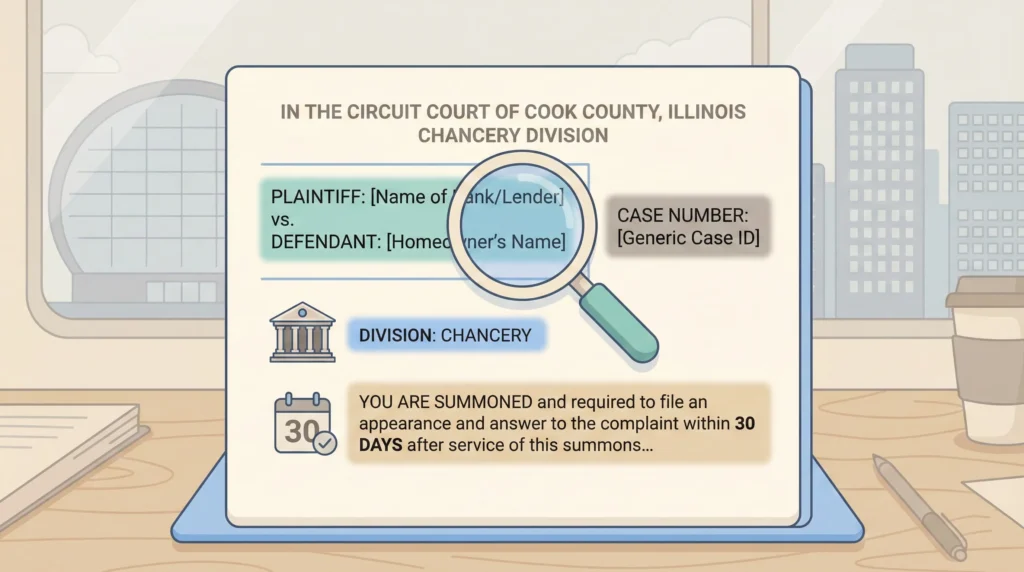

Your foreclosure summons is not a warning that the bank might sue you someday. It is proof that a lawsuit has already been filed in the Circuit Court of Cook County. The caption at the top will say something like In the Circuit Court of Cook County, Illinois, County Department, Chancery Division and list your lender or servicer as the plaintiff and you as the defendant. Residential mortgage foreclosure cases are assigned to the Mortgage Foreclosure and Mechanics Lien Section of that division at the Daley Center.

In plain language, the summons is the court telling you three things at once: you have been sued for mortgage foreclosure, you must respond within a specific number of days, and if you do not, the court can move forward without you and enter orders that affect your home and your rights.

On the Cook County mortgage foreclosure summons form, you will usually see three big ideas on the first page:

Start at the very top of the summons. The first lines tell you which court you are in and confirm that this is an Illinois judicial foreclosure. You will see In the Circuit Court of Cook County, Illinois, County Department, Chancery Division, which means this is not a small-claims case or a collection action. It is an equity case assigned to the Chancery Division at the Daley Center.

Below that, the case caption lists the plaintiff—often your lender, servicer, or a trustee for a mortgage-backed security—versus you and any other defendants such as co-borrowers, junior lienholders, or condo or HOA associations. To the right, you will see the case number and sometimes a calendar or judge code showing which judge or courtroom your case is assigned to in the foreclosure section.

Many Cook County summonses also list a Case Management Date with a time and courtroom for an initial status hearing. That date is important, but it is separate from the 30-day deadline to file your appearance and answer. Your seven-day plan needs to calendar both: the 30-day response deadline counted from the date you were served and any first case-management date listed on the form.

The heart of the summons is the instruction that you must file an appearance and an answer or other response within 30 days after service, not counting the day you were served. This language comes from the Illinois Supreme Court Rules and the standardized appearance and answer forms used in mortgage foreclosure cases. If you miss this deadline, the foreclosure case can move forward without you and the court can enter a default judgment of foreclosure and sale.

Homeowners and even professionals run into the same traps again and again around this 30-day clock:

If you do nothing after being served, the foreclosure case does not disappear. Once your 30 days run and you have not appeared or answered, the plaintiff can ask the court to enter a default against you. After default, the lender can move for a judgment of foreclosure and sale, which sets the amount claimed due, approves the plaintiff’s right to foreclose, and lays out the framework for a sheriff’s sale.

Illinois law still gives you statutory rights to reinstate the loan within a certain time or redeem the property by paying it off in full, but it becomes much harder to control timing and options once a judgment is in place. Ignoring the summons also means the judge never hears about servicing errors, payment disputes, or real-world facts—like a pending modification review—that could affect how the case should be managed.

In uncontested Illinois cases, it is common for foreclosures to run their course in roughly a year to fifteen months from filing to eviction. The earlier you engage with the case, the more control you have over how and when it ends.

Your summons gives you a narrow but powerful 30-day window to show the court that you are paying attention and that you want a say in what happens to your home. In real files, we can do a lot with that window.

In a 30-Day Window Strategy Session, we walk through your summons, complaint, payment history, and budget; identify any obvious defenses or leverage points; and build a plan for your appearance, answer, and early motions. The goal is simple: when you walk into the Chancery Division, you already know what the next few months should look like instead of hoping for the best in the hallway.

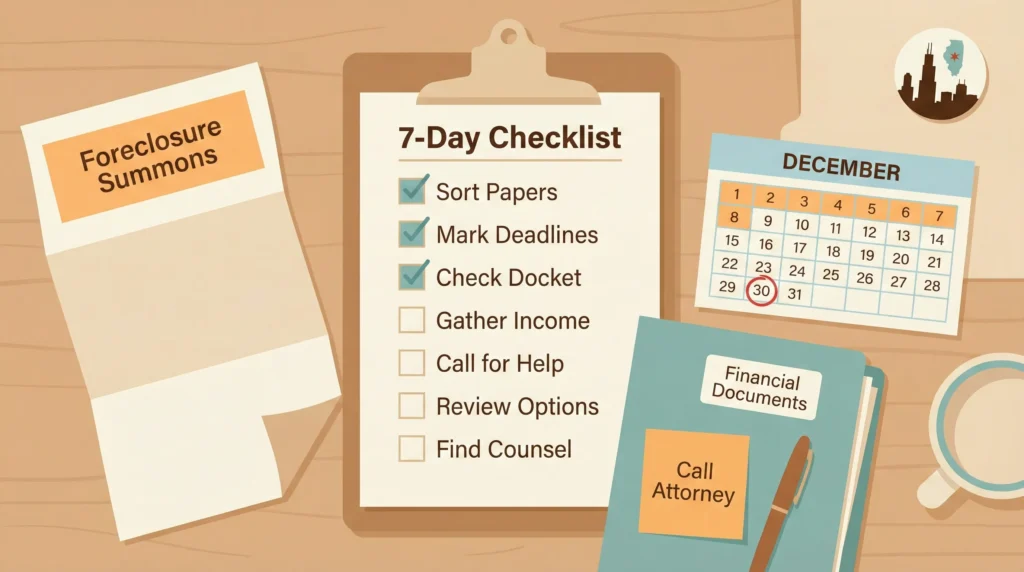

The summons gives you roughly a month to respond. The first seven days are where you set the tone. Here is a practical, file-driven checklist we use with Cook County homeowners in that first week.

When a Cook County homeowner brings us a foreclosure summons, we do not start with generic talk about the foreclosure crisis. We start with the document in front of us and the court that issued it. In our office, a summons review typically includes:

The result is that you stop treating the summons as a mysterious threat and start treating it as a structured lawsuit that you and your team can actually manage.

The Cook County mortgage foreclosure summons sitting on your table is not going away on its own. What you do with it in the next seven days determines whether you walk into the Chancery Division with a clear plan or let the case move forward without you.

If you want help reading the summons, plotting your deadlines, and understanding how this lawsuit fits with your broader real-estate and financial picture, schedule a Summons Strategy Session with The Bow Tie Attorney. We treat your file like a live deal and a live case—because that is exactly what it is.

The summons is your official notice that a lawsuit has been filed against you in the Circuit Court of Cook County. To participate in the case, you must file an appearance and an answer or other response within 30 days after you were served, and the court expects you or your attorney to track and attend scheduled court dates. If you do not respond, the court can enter a default and move toward judgment of foreclosure and sale without hearing from you. Showing up in the hallway without filing anything is not enough to protect your rights.

Your appearance tells the court you know about the case and gives the clerk your contact information so you receive future notices. Your answer or other responsive pleading tells the court whether you admit or deny the allegations in the complaint and what defenses you may have. Illinois provides standardized Appearance and Answer forms for mortgage foreclosure, but you still have to decide what to check, what to admit, what to deny, and whether any defenses apply. Many homeowners choose to have counsel handle this because mistakes at the pleading stage can affect the rest of the case.

A genuine foreclosure summons in Cook County will say In the Circuit Court of Cook County, Illinois, County Department, Chancery Division at the top, list a case number, and be accompanied by a mortgage foreclosure complaint. It is usually delivered by a sheriff or licensed process server, not tucked into a stack of junk mail. Most residential summons packets also include a Homeowner Notice in English and Spanish explaining that a foreclosure case has been filed. If you are not sure whether what you received is a real court summons, a quick check of the Cook County online docket using your name or the case number will usually confirm it.

Illinois law requires that a Homeowner Notice be attached to the summons in all residential foreclosure cases. That notice must be in at least 12-point type and in both English and Spanish, and it is designed to explain in plain language that a foreclosure case has been filed, that you have rights and deadlines, and that housing-counseling and legal-aid resources exist. It is not a substitute for the summons and complaint, but it is an important part of understanding the big picture and should not be thrown away.

Working with your loan servicer on loss mitigation is crucial, but it does not replace your obligations in the court case. The judge in the Chancery Division can only see what is filed in the court record, not what was promised on the phone. Mediation programs and federal servicing rules can create real opportunities to modify or resolve your loan, but those tools live alongside the foreclosure lawsuit, not instead of it. The safest approach is to treat the court case and the loan file as two tracks that must be managed together, not to pick one and ignore the other.

The best time to call is within the first week after you are served, while your 30-day deadline is still far enough away to give us room to plan. In that window, we can review the summons and complaint, explain your judge and calendar, map out your deadlines under Illinois law, and coordinate with any loss-mitigation or mediation options before the case takes on a life of its own. Waiting until the eve of a default motion or a judgment hearing limits what we can do. Calling early almost never hurts; calling late can close doors that were open in week one.

Stay ahead of industry changes with our comprehensive continuing education program. New courses added monthly, covering everything from legal updates to market trends.

Connect with like-minded professionals who share your commitment to excellence. Build relationships that last beyond any single transaction or market cycle.

Position yourself as the go-to expert in your market. Our advanced certifications and specializations help you stand out in an increasingly competitive landscape.

“Excellence is not a skill, it’s an attitude. In real estate, that attitude translates to meticulous preparation, unwavering ethics, and an uncompromising commitment to client success.”

— Mahmoud Faisal Elkhatib, The Bow Tie Attorney